E-commerce payment methods that boost sales confidence

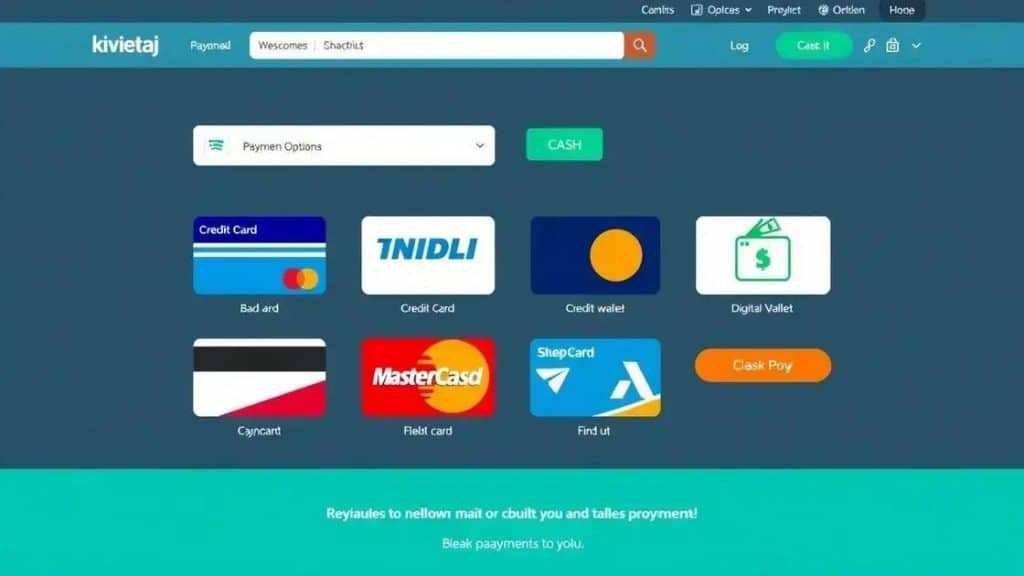

E-commerce payment methods include credit cards, digital wallets, bank transfers, and buy now, pay later options, each with unique benefits that enhance customer experience and security in online transactions.

E-commerce payment methods play a crucial role in online shopping. But have you ever stopped to consider how they affect customer decisions? Let’s dive into what makes these methods so vital and how they can enhance the shopping experience.

Understanding different e-commerce payment methods

Understanding different e-commerce payment methods is essential for online retailers. The right payment option can enhance customer trust and lead to increased sales. Today, we will explore various types of payment methods available for e-commerce.

Types of Payment Methods

There are several popular payment methods you can consider for your online store. Each has its own pros and cons that could impact your customers’ shopping experience.

- Credit and Debit Cards: These are among the most commonly used methods. They offer convenience but may come with processing fees.

- Digital Wallets: Options like PayPal and Apple Pay allow quick transactions without the need to enter card details every time.

- Bank Transfers: Direct transfers can be safe, but they may take longer for confirmation.

- Buy Now, Pay Later: Services like Afterpay let customers split payments, encouraging larger purchases.

Another important aspect to consider is security. Customers want to feel safe when making purchases online. A secure payment gateway can make a big difference in their confidence level.

Additionally, offering multiple payment methods can cater to a broader audience. Some customers may prefer one method over another based on their personal preferences or experiences. Thus, providing choices can be beneficial to both parties.

Choosing the Right Payment Option

When selecting payment methods, keep your target market in mind. Are they more likely to use credit cards or digital wallets? This choice can affect your sales performance. Analyze customer behavior to determine the best options to include in your store.

User-friendly interfaces also play a critical role in the payment process. A complicated checkout experience can lead to cart abandonment. Make sure the payment process is as straightforward as possible.

Pros and cons of various payment options

When considering the pros and cons of various payment options, it’s essential to evaluate each method carefully. Each option offers unique benefits and drawbacks that can influence customer choice and sales performance.

Credit and Debit Cards

Credit and debit cards are widely accepted. They provide a quick and convenient way for customers to pay. However, businesses must be aware of transaction fees that can eat into profits. Additionally, customers may hesitate to use cards if they feel their information is not secure.

- Pros: Fast transactions, high acceptance rate, and potential for rewards.

- Cons: Processing fees and security concerns.

Digital Wallets

Digital wallets, such as PayPal and Google Pay, are becoming increasingly popular due to their convenience. They allow quick transfers without the need to input credit card details on each purchase. On the downside, not everyone uses digital wallets, which may limit your customer base.

Security is a significant advantage with digital wallets. They often have built-in measures to protect user information. However, be aware that some customers may prefer traditional methods over digital ones.

Bank Transfers

Bank transfers are another method, known for being secure. They are especially useful for high-value transactions. But one major downside is the processing time, which can delay order fulfillment and frustrate customers.

- Pros: High security and ideal for large payments.

- Cons: Slow processing times and potential for customer confusion.

Buy Now, Pay Later

This service has gained popularity, particularly among younger buyers. It allows customers to make purchases without immediate payment, encouraging larger spending. However, it can lead to financial strain on customers if they don’t manage payments well.

Every payment option comes with trade-offs. Understanding these can help you choose the best methods for your online store. Evaluating your target audience’s preferences is crucial for maximizing sales and enhancing customer satisfaction.

How to choose the right payment platform for your store

Choosing the right payment platform for your store is crucial for a successful e-commerce business. The right choice will enhance customer experience and boost your sales.

Identify Your Business Needs

The first step is to identify what your business specifically needs. Consider factors such as your target audience, your product types, and your expected sales volume. This will give you clarity on which features are vital for your payment platform.

For instance, if you sell high-ticket items, a platform offering secure transactions and larger payment limits may be necessary. Conversely, if you run a small shop with lower sales, focusing on transaction fees might be more beneficial.

Evaluate Payment Methods Offered

Different platforms offer various payment methods. Some may support credit cards, while others may also include digital wallets or buy-now-pay-later options. It’s essential to choose a platform that accommodates methods your customers prefer.

- Credit and Debit Cards: Widely used by most customers.

- Digital Wallets: Offer convenience for on-the-go shoppers.

- Bank Transfers: Good for large transactions.

- Alternate Payment Options: Consider options like cryptocurrency.

Assess Security Features

Security should be a top priority when selecting a payment platform. Look for options that offer encryption and fraud protection to keep both your business and customers safe.

Additionally, ensure that the platform complies with necessary regulations such as PCI DSS. This compliance ensures that the platform adheres to security standards for processing payments.

Consider Costs and Fees

Understand the fee structure associated with each payment platform. Costs can vary dramatically based on transaction size, payment types, and monthly fees. It’s essential to calculate how these fees may affect your overall profits.

Sometimes, a platform with higher upfront costs can provide better features and security in the long run. Always weigh the costs against the services offered.

Current trends in e-commerce payment solutions

Staying updated with the current trends in e-commerce payment solutions is vital for online businesses. As technology evolves, so do the preferences of consumers and the capabilities of various payment systems.

Mobile Payments

Mobile payment options are rising in popularity. With smartphones in nearly everyone’s hands, shoppers enjoy the convenience of paying through apps like Apple Pay and Google Pay. These platforms allow users to make purchases quickly, often with just a tap. As a result, many businesses are optimizing their checkout processes to cater specifically to mobile users.

Contactless Payments

In the wake of the pandemic, contactless payments have gained significant traction. Customers appreciate the added safety and convenience. This trend has led many retailers to adopt point-of-sale systems capable of handling contactless methods.

Moreover, the availability of contactless technology is expanding beyond just retail. Restaurants, service providers, and online stores are now integrating contactless options, appealing to health-conscious consumers.

Cryptocurrency Acceptance

Another emerging trend is the acceptance of cryptocurrencies as a payment method. While still in its infancy, many e-commerce platforms are beginning to accept Bitcoin and Ethereum. This move caters to a new generation of buyers who prefer using digital currencies.

- Advantages: Lower transaction fees and appealing to tech-savvy consumers.

- Drawbacks: Volatility and regulatory concerns may deter some businesses.

Buy Now, Pay Later Services

Buy now, pay later (BNPL) services are soaring in popularity. These solutions allow customers to purchase items and pay in installments, making it easier to afford larger purchases. This flexibility can boost sales and reduce cart abandonment.

Many shoppers, particularly younger ones, prefer splitting payments without incurring interest. Therefore, offering BNPL options can be an excellent strategy for e-commerce retailers looking to increase the average order value.

Enhanced Security Measures

As digital payments grow, so does the need for enhanced security. Customers want to know that their personal and financial information is safe. Payment gateways are increasingly incorporating advanced security measures such as biometric authentication and machine learning to detect fraudulent activities.

These advancements ensure customers can shop with confidence, fostering loyalty and repeat business.

In conclusion, understanding the various e-commerce payment methods and their trends is essential for any online business looking to thrive today. From mobile payments and contactless solutions to the increasing acceptance of cryptocurrencies, it’s clear that the landscape is rapidly changing. Businesses must adapt to these trends to meet customer preferences and ensure secure transactions. By offering diverse payment options and creating a safe shopping experience, retailers can enhance customer satisfaction and drive more sales. Ultimately, staying informed about the latest trends in e-commerce payment solutions will empower businesses to succeed in the competitive online marketplace.

FAQ – Frequently Asked Questions about E-commerce Payment Methods

What are the most popular e-commerce payment methods?

The most popular e-commerce payment methods include credit and debit cards, digital wallets like PayPal, bank transfers, and buy now, pay later services.

How can mobile payments improve my online business?

Mobile payments offer convenience, allowing customers to shop easily on their smartphones, which can lead to increased sales and customer satisfaction.

What security measures should I look for in a payment platform?

Look for payment platforms that offer encryption, PCI compliance, and fraud detection to protect your customers’ information and build trust.

How can accepting cryptocurrency benefit my store?

Accepting cryptocurrency can attract tech-savvy customers and lower transaction fees compared to traditional payment methods, boosting your sales potential.