Fintech Go-to-Market: Reaching 1M US Users by 2025

Optimizing your fintech startup’s go-to-market strategy for 2025 is crucial for reaching 1 million users in the US by focusing on scalable acquisition channels, regulatory compliance, and a compelling value proposition.

The highly competitive landscape of financial technology demands more than just an innovative product; it requires a meticulously planned and executed go-to-market strategy. This guide focuses on equipping your startup with the actionable insights needed for optimizing your fintech startup’s go-to-market strategy for 2025, aiming squarely at the ambitious goal of reaching one million users in the United States.

Understanding the US Fintech Landscape in 2025

The US fintech market is characterized by rapid innovation, evolving regulatory frameworks, and diverse consumer needs. Success hinges on a nuanced understanding of these dynamics, allowing startups to position their products effectively.

As we approach 2025, key trends are shaping consumer behavior and technological adoption. These include the increasing demand for personalized financial services, the rise of embedded finance, and a heightened focus on data security and privacy. Fintech startups must not only observe these trends but actively integrate them into their core offerings and communication.

Regulatory Compliance and Trust Building

Navigating the complex regulatory environment in the US is paramount for any fintech. Compliance isn’t merely a legal obligation; it’s a cornerstone of building trust with consumers and partners.

- State-by-state licensing: Understand and secure necessary money transmitter licenses or other state-specific approvals.

- Federal regulations: Adhere to federal laws such as the Bank Secrecy Act (BSA), Anti-Money Laundering (AML), and consumer protection acts like the CFPB guidelines.

- Data privacy: Implement robust data privacy protocols aligned with state laws like CCPA and evolving federal standards.

Building trust extends beyond compliance. Transparent communication about data handling, clear terms of service, and responsive customer support are vital. Consumers are more likely to adopt fintech solutions from companies they perceive as secure and ethical.

In conclusion, a deep dive into the US fintech landscape of 2025 reveals a market ripe with opportunity but also fraught with regulatory complexities. Startups must prioritize both innovation and an unwavering commitment to compliance and trust to gain a foothold and scale effectively.

Defining Your Target User and Value Proposition

Before launching into the market, a clear definition of your target user and a compelling value proposition are indispensable. These elements form the bedrock of all subsequent go-to-market activities, ensuring your efforts are focused and resonate with the right audience.

Many fintech startups falter by casting too wide a net or failing to articulate what makes their solution uniquely valuable. Pinpointing specific demographics, psychographics, and pain points allows for precision targeting and a more efficient allocation of resources.

Crafting a Unique Value Proposition

Your value proposition should clearly state how your product solves a problem or fulfills a need better than existing alternatives. It’s not just about features; it’s about the tangible benefits users will experience.

- Identify core pain points: What financial challenges does your target audience face that your product addresses?

- Highlight differentiation: What makes your solution stand out from competitors? Is it cost, convenience, innovation, or a unique feature set?

- Quantify benefits: Where possible, articulate the value in measurable terms (e.g., “save X hours per month,” “reduce fees by Y%”).

The value proposition must be concise, memorable, and consistently communicated across all marketing channels. It should be the central message that underpins your brand identity and all user-facing content.

Understanding your ideal user goes beyond basic demographics. It involves delving into their financial habits, technological fluency, and aspirations. Creating detailed user personas can help in visualizing these segments, enabling more personalized product development and marketing messages.

Ultimately, a well-defined target user and a robust value proposition are critical for establishing market relevance and attracting early adopters. These foundational steps ensure that your go-to-market strategy is built on a solid understanding of who you serve and why they should choose you.

Strategic User Acquisition Channels for Growth

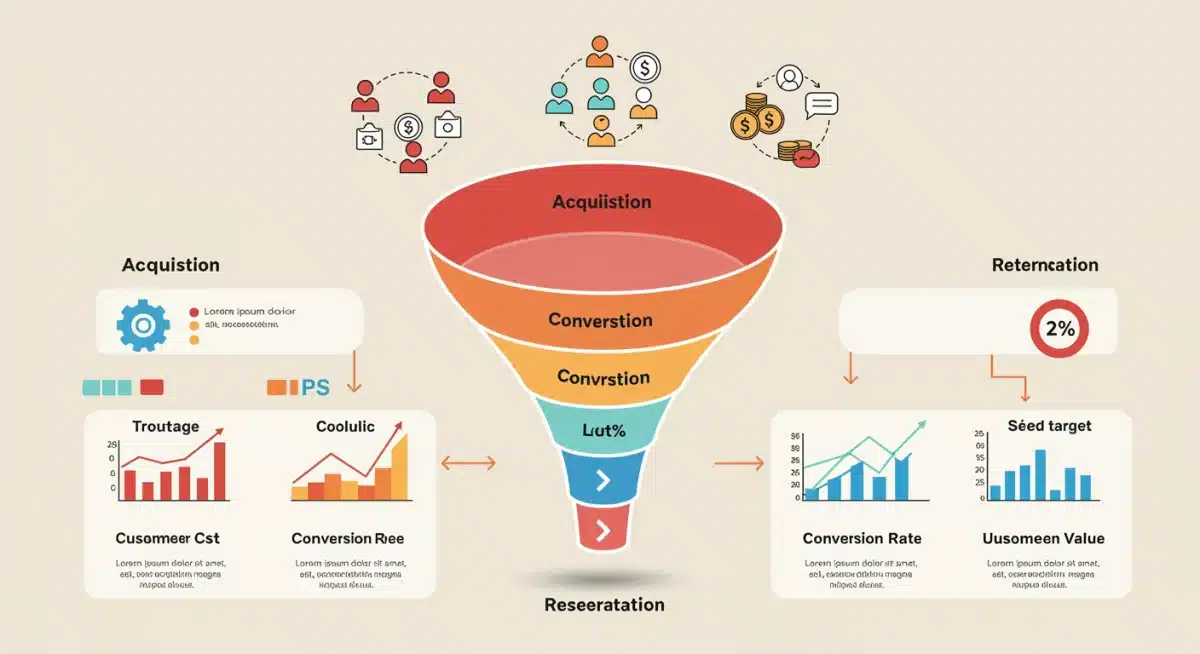

Achieving one million users in the US by 2025 demands a multi-pronged approach to user acquisition. Relying on a single channel is risky; a diversified strategy ensures resilience and scalability, tapping into various segments of your target audience.

The US market offers a vast array of acquisition channels, each with its own advantages and challenges. The key is to identify which channels align best with your target demographic and offer the most efficient path to conversion.

Leveraging Digital Marketing and Content

Digital channels remain at the forefront of user acquisition for fintechs. They offer unparalleled targeting capabilities and measurable results.

- Search Engine Optimization (SEO): Optimize your website and content for relevant keywords to attract organic traffic from users actively searching for financial solutions.

- Paid Advertising (SEM, Social Media Ads): Utilize platforms like Google Ads, Facebook, Instagram, and LinkedIn to reach highly specific audience segments with targeted campaigns.

- Content Marketing: Create valuable blog posts, whitepapers, webinars, and videos that educate your audience, build thought leadership, and drive inbound leads.

Beyond digital, strategic partnerships can unlock significant growth. Collaborating with complementary businesses, financial institutions, or even non-fintech entities can provide access to new user bases and enhance credibility. Affiliate marketing and influencer partnerships also present scalable opportunities, especially when targeting niche communities.

Viral loops and referral programs are powerful tools for organic growth, especially once an initial user base is established. Incentivizing existing users to invite new ones can significantly reduce customer acquisition costs and foster a community around your product.

In summary, a comprehensive user acquisition strategy for 2025 must integrate diverse digital marketing tactics with strategic partnerships and organic growth mechanisms. Continuous testing and optimization of these channels are essential for achieving scalable user growth.

Product-Led Growth and User Experience

In the competitive fintech space, your product itself must be a primary driver of acquisition and retention. A seamless, intuitive, and valuable user experience (UX) fosters organic growth through word-of-mouth and reduces churn, directly contributing to the goal of one million users.

Product-led growth (PLG) emphasizes making the product the main vehicle for customer acquisition, conversion, and expansion. This approach prioritizes user satisfaction and allows the product’s inherent value to speak for itself, minimizing reliance on heavy sales and marketing efforts.

Designing for Intuition and Engagement

A superior UX isn’t just about aesthetics; it’s about functionality, responsiveness, and emotional connection. Fintech products must instill confidence and simplify complex financial tasks.

- Onboarding simplicity: Streamline the sign-up process, making it quick and frictionless, while still adhering to KYC/AML requirements.

- Intuitive interface: Design clean, easy-to-navigate interfaces that minimize cognitive load and guide users effortlessly through tasks.

- Personalization: Offer customizable features and personalized insights that make the product feel tailored to individual user needs.

Beyond initial experience, continuous engagement is crucial. This can be achieved through features that encourage regular interaction, such as personalized financial insights, goal tracking, and gamification elements. Push notifications and in-app messaging, when used judiciously, can also drive re-engagement.

Collecting and acting on user feedback is another cornerstone of product-led growth. Utilizing surveys, in-app feedback tools, and user testing allows for iterative improvements that directly address user pain points and enhance satisfaction. This continuous feedback loop ensures the product evolves in line with user expectations.

To summarize, embedding product-led growth principles and prioritizing an exceptional user experience are vital for sustainable user acquisition in fintech. A product that delights users becomes its own best marketing tool, driving both adoption and loyalty.

Data-Driven Iteration and Optimization

Reaching one million users by 2025 is not a static goal but an evolutionary process that demands constant monitoring, analysis, and adaptation. A data-driven approach allows fintech startups to identify what works, what doesn’t, and where to pivot their strategies for maximum impact.

Without robust analytics, go-to-market efforts can quickly become inefficient, wasting valuable resources. Establishing clear key performance indicators (KPIs) and regularly tracking them provides the necessary insights to refine acquisition channels, improve product features, and enhance user experience.

Key Metrics for Success

Focusing on the right metrics helps in making informed decisions. Beyond vanity metrics, concentrate on those that directly correlate with user growth and business health.

- Customer Acquisition Cost (CAC): Understand how much it costs to acquire a new user across different channels.

- Lifetime Value (LTV): Measure the total revenue a customer is expected to generate over their relationship with your product.

- Churn Rate: Track the rate at which users discontinue using your service, identifying areas for improvement in retention.

- Conversion Rates: Monitor conversion at every stage of the user journey, from initial impression to active usage.

Implementing A/B testing across marketing campaigns, onboarding flows, and product features allows for empirical validation of changes. Small, iterative improvements based on data can lead to significant gains in user acquisition and engagement over time. This scientific approach minimizes risk and maximizes the return on investment for marketing and product development efforts.

A robust analytics infrastructure is non-negotiable. This includes choosing the right tools for data collection, visualization, and reporting, ensuring that insights are accessible and actionable across the team. From marketing specialists to product managers, everyone should be empowered to make data-informed decisions.

In essence, data-driven iteration and optimization are the engines of sustainable growth for fintech startups. By continuously measuring, analyzing, and adapting, companies can navigate the complexities of the US market and efficiently scale towards their user acquisition goals.

Building a Scalable Infrastructure and Team

Achieving the ambitious goal of one million users by 2025 necessitates not only a strong strategy but also a robust, scalable infrastructure and a high-performing team. Growth can quickly outpace capabilities if the underlying systems and human resources are not adequately prepared.

Scalability in fintech applies to technology, operations, and personnel. Anticipating future demands and building systems that can handle increased load without compromising performance or security is crucial for sustained success.

Technology Stack and Operational Efficiency

The choice of technology stack profoundly impacts a fintech’s ability to scale. Cloud-native architectures, microservices, and APIs are foundational for flexibility and growth.

- Cloud infrastructure: Utilize scalable cloud platforms (AWS, Azure, Google Cloud) that can dynamically adjust resources based on user demand.

- API-first approach: Design your product with APIs in mind to facilitate integrations with partners and enable future product extensions.

- Automate processes: Implement automation for onboarding, customer support, and compliance checks to improve efficiency and reduce manual errors.

Equally important is building a team that is not only skilled but also adaptable and aligned with the company’s vision. Hiring the right talent, fostering a culture of innovation, and providing continuous learning opportunities are key to maintaining momentum. As the user base grows, so too will the demands on customer support, engineering, and compliance teams.

Investing in strong leadership and clear communication channels within the organization helps in navigating the challenges of rapid expansion. A well-structured team with defined roles and responsibilities ensures that everyone is working cohesively towards the common goal.

In conclusion, a scalable infrastructure and a talented, adaptable team are the backbone of any fintech startup aiming for significant user growth. Proactive planning for technological and operational scalability, coupled with strategic talent acquisition and development, will be instrumental in reaching and sustaining one million users.

| Key Aspect | Brief Description |

|---|---|

| US Market Nuances | Understanding regulatory complexity and diverse consumer demands is crucial for effective market entry. |

| User & Value Proposition | Clearly define your target audience and articulate unique benefits to ensure product-market fit. |

| Acquisition Channels | Diversify digital marketing, partnerships, and referral programs for scalable user growth. |

| Data-Driven Optimization | Leverage analytics and KPIs for continuous iteration and refinement of strategies. |

Frequently Asked Questions

The most critical first step is a comprehensive understanding of the US regulatory landscape, including state-specific licensing and federal compliance requirements. This foundation ensures legal operation and builds essential trust with potential users and partners.

Differentiation comes from clearly defining a unique value proposition that addresses specific user pain points better than competitors. This often involves superior user experience, niche targeting, innovative technology, or a distinct business model.

Data is fundamental for optimization. It enables startups to track KPIs, understand user behavior, measure channel effectiveness, and conduct A/B testing. This data-driven approach allows for continuous iteration and refinement of acquisition and retention strategies.

While highly effective, product-led growth (PLG) is most suitable for fintechs with intuitive, self-service products that offer immediate value. It emphasizes excellent user experience and relies on the product itself to drive acquisition, conversion, and expansion.

Strategic partnerships are extremely important. They can provide access to new user bases, enhance credibility, and offer complementary services. Collaborating with other businesses or financial institutions can significantly accelerate user acquisition and market penetration.

Conclusion

Achieving the ambitious goal of one million users in the US by 2025 for a fintech startup is a monumental task that demands a holistic and adaptable strategy. It begins with a profound understanding of the US market’s regulatory intricacies and consumer preferences. Success hinges on a clearly articulated value proposition, a diversified approach to user acquisition, a product designed for exceptional user experience, and an unwavering commitment to data-driven iteration. Furthermore, building a scalable infrastructure and a high-performing team is paramount to sustaining growth. By meticulously planning and executing these interconnected strategies, fintech startups can confidently navigate the competitive landscape and realize their ambitious user growth targets.