US Open Banking Adoption 2025: Bank Readiness & Fintech Integration

By 2025, US Open Banking Adoption is poised for significant growth, driven by evolving regulatory landscapes and increasing consumer demand for integrated financial services, necessitating a comprehensive comparison of bank readiness and fintech integration strategies.

The landscape of financial services in the United States is undergoing a profound transformation, with US Open Banking Adoption emerging as a pivotal force. This shift promises a future where consumers have greater control over their financial data, enabling seamless integration with innovative fintech applications. We delve into the projected state of this evolution by 2025, examining how traditional banks are preparing and how fintech companies are leveraging these new capabilities.

Understanding the foundations of US Open Banking

Open banking, at its core, redefines how financial data is shared between institutions and third-party providers. In the US context, this movement is less about strict regulatory mandates and more about market-driven innovation and evolving consumer expectations. The foundational elements involve secure APIs and standardized data protocols.

This shift empowers consumers by allowing them to share their financial data securely with third-party applications, leading to more personalized and efficient financial management tools. The focus is on consent-driven data sharing, ensuring privacy and control remain paramount.

Key components driving the evolution

The evolution of open banking in the US is propelled by several critical components, each playing a vital role in shaping its trajectory. These elements range from technological advancements to shifts in consumer behavior and industry collaboration.

- API standardization: The development and adoption of common API standards are crucial for seamless data exchange between diverse financial entities.

- Data security protocols: Robust security measures and encryption are fundamental to building trust and protecting sensitive financial information.

- Consumer consent frameworks: Clear and transparent mechanisms for obtaining and managing consumer consent are essential for ethical data sharing.

- Interoperability: Ensuring that different systems and platforms can communicate effectively is key to a truly integrated open banking ecosystem.

The establishment of these foundational elements is not just a technical endeavor; it requires significant collaboration across the financial industry. Banks, fintechs, and regulators must work in concert to define and implement the necessary infrastructure for widespread US Open Banking Adoption.

Ultimately, understanding these foundational aspects is critical for appreciating the complexities and opportunities that open banking presents. It lays the groundwork for evaluating the readiness of various players and the potential for transformative fintech integrations.

Bank readiness: traditional institutions on the open banking curve

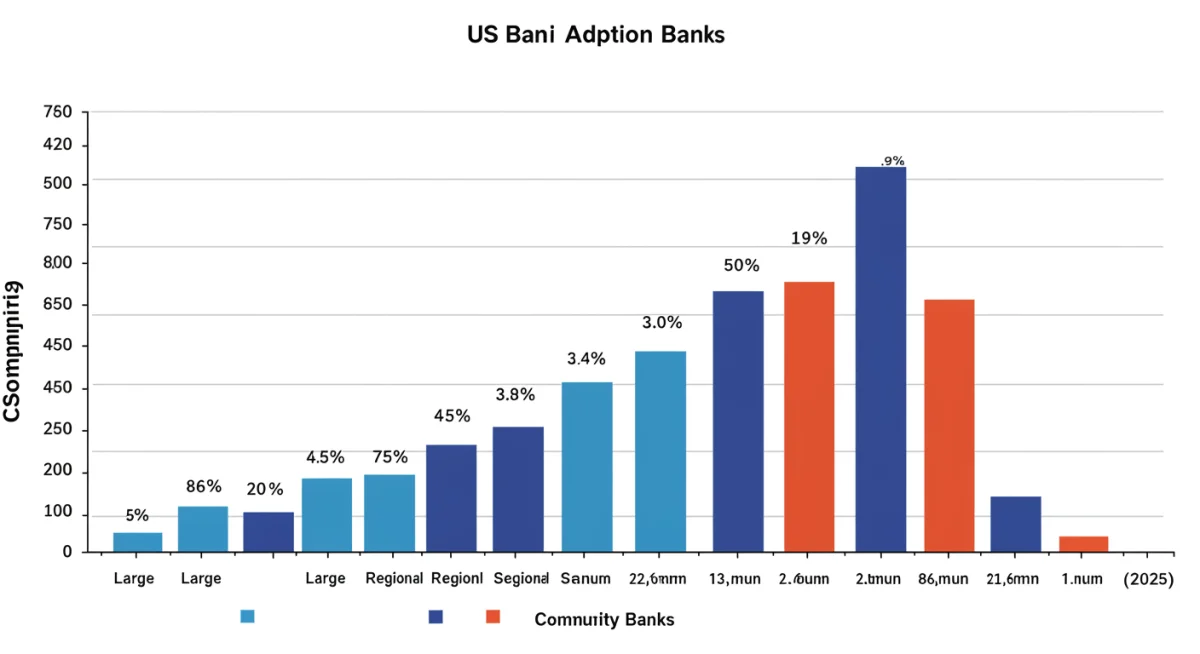

Traditional banks in the US are navigating a complex path towards open banking readiness. While some large institutions have made significant strides, regional and community banks often face unique challenges in adopting new technologies and integrating with fintech partners. Their approach to open banking is largely influenced by their existing infrastructure, customer base, and strategic priorities.

Many larger banks have already invested heavily in API development and data infrastructure, recognizing the competitive advantage of offering enhanced digital services. However, smaller banks are often constrained by legacy systems and limited resources, making the transition more arduous.

Challenges and opportunities for banks

The journey for traditional banks into the open banking era is fraught with both significant hurdles and compelling opportunities. Addressing these challenges while capitalizing on opportunities will determine their success in the evolving financial landscape.

- Legacy infrastructure: Modernizing outdated IT systems is a major undertaking, requiring substantial investment and strategic planning.

- Security concerns: Protecting customer data in an open ecosystem demands advanced cybersecurity measures and continuous vigilance.

- Regulatory navigation: Understanding and complying with an evolving patchwork of data privacy and financial regulations is critical.

- Talent acquisition: Recruiting and retaining skilled talent in API development, data science, and cybersecurity is a perennial challenge.

Despite these challenges, open banking offers banks a chance to innovate their product offerings, attract new customer segments, and streamline operations. By collaborating with fintechs, banks can extend their reach and provide more personalized financial solutions without having to build everything in-house.

The varying levels of bank readiness will significantly shape the pace and scope of US Open Banking Adoption. Institutions that embrace this shift proactively will likely gain a competitive edge, while those that lag may find themselves struggling to keep pace with consumer expectations and market demands.

Fintech integration: leveraging open banking for innovation

Fintech companies are at the forefront of leveraging open banking capabilities to drive innovation. Their agility and focus on specific customer pain points allow them to rapidly develop and deploy solutions that integrate seamlessly with bank data, provided the necessary APIs are available.

This integration enables fintechs to create a new generation of financial products, from personalized budgeting tools and automated investment platforms to more efficient lending and payment solutions. The ability to access real-time financial data, with customer consent, is a game-changer for these innovators.

Innovative applications and services

The potential for innovative applications and services fueled by open banking is vast, transforming how consumers interact with their money and manage their financial lives. Fintechs are leading this charge, developing solutions that address previously unmet needs.

- Personalized financial management: Aggregating data from multiple accounts to provide a holistic view of finances and personalized advice.

- Streamlined lending: Using real-time transaction data to assess creditworthiness more accurately and expedite loan approvals.

- Automated savings and investments: Connecting bank accounts to automatically save or invest small amounts based on spending patterns.

- Enhanced payment experiences: Facilitating direct bank-to-bank payments, reducing reliance on traditional card networks.

The success of fintech integration hinges on the robustness and accessibility of bank APIs, as well as clear data sharing agreements. As more banks open their data, the pace of fintech innovation is expected to accelerate dramatically, offering consumers an ever-expanding array of choices.

Fintechs are not just building new products; they are redefining user experiences and setting new standards for convenience and efficiency. Their role is indispensable in translating the technical potential of open banking into tangible benefits for everyday users, thereby driving broader US Open Banking Adoption.

Regulatory landscape and consumer trust by 2025

By 2025, the US regulatory landscape for open banking is expected to be more defined, though perhaps not as prescriptive as in other regions like Europe. The Consumer Financial Protection Bureau (CFPB) has been a key player, signaling its intent to establish clearer rules around data portability and consumer control.

Building and maintaining consumer trust is paramount for the success of open banking. Without confidence in data security and privacy, consumers will be hesitant to share their financial information, regardless of the benefits offered. Transparency and robust consent mechanisms are crucial in this regard.

Evolving regulations and privacy concerns

The evolving regulatory environment, coupled with persistent privacy concerns, forms a critical backdrop for the advancement of open banking in the US. Balancing innovation with consumer protection is a delicate act that regulators are actively trying to refine.

While a single, overarching open banking regulation similar to Europe’s PSD2 may not emerge, a more fragmented but effective framework is likely. This could involve a combination of industry standards, state-level initiatives, and federal guidance, all working towards a common goal of secure data portability.

Consumer education also plays a vital role in fostering trust. Clear communication about how data is used, who it is shared with, and the benefits of participating in open banking will be essential for widespread acceptance. Financial literacy programs focusing on digital banking security will become increasingly important.

Ultimately, the regulatory environment and the level of consumer trust will significantly influence the speed and depth of US Open Banking Adoption. A well-balanced approach that protects consumers while fostering innovation is vital for a thriving open banking ecosystem.

Comparative analysis: bank vs. fintech approaches

The approaches taken by traditional banks and agile fintechs towards open banking present a fascinating contrast. While both aim to serve consumers better, their starting points, capabilities, and strategic imperatives differ significantly. This comparison highlights the dynamic tension and collaborative potential within the US financial sector.

Banks, with their established customer bases and regulatory obligations, often move with caution, prioritizing security and compliance. Fintechs, on the other hand, prioritize speed, user experience, and niche solutions, often pushing the boundaries of what’s possible with financial data.

Strategic differences and synergies

Understanding the strategic differences between banks and fintechs is key to appreciating the evolving landscape of US Open Banking Adoption. However, it is equally important to recognize the growing synergies that benefit both parties and, ultimately, the consumer.

- Risk appetite: Banks typically have a lower risk appetite due to their fiduciary responsibilities, while fintechs are often more willing to experiment with new models.

- Customer acquisition: Banks leverage existing relationships, whereas fintechs often focus on digital channels and innovative marketing to attract users.

- Infrastructure: Banks contend with legacy systems, necessitating significant upgrades, while fintechs are built on modern, cloud-native architectures.

- Regulatory burden: Banks operate under extensive regulatory scrutiny, whereas fintechs, while regulated, often have more flexibility in their early stages.

Despite these differences, there is a growing recognition that collaboration offers mutual benefits. Banks can gain access to cutting-edge technology and innovative customer experiences, while fintechs can leverage banks’ trust, scale, and access to capital. This symbiotic relationship is crucial for accelerating open banking initiatives.

The comparative analysis reveals that a hybrid model, combining the strengths of both traditional banking and fintech innovation, is likely to define the future of US Open Banking Adoption. This collaborative spirit will drive more comprehensive and effective financial solutions.

The future outlook for US open banking adoption by 2025

Looking ahead to 2025, the trajectory for US Open Banking Adoption appears promising, albeit with its own set of unique challenges and opportunities. The ecosystem is expected to mature significantly, moving beyond nascent stages to a more integrated and widely accepted model.

Key indicators suggest an acceleration in both bank participation and fintech innovation. Consumer demand for personalized, seamless financial experiences will continue to be a primary driver, compelling institutions to adapt and embrace open banking principles.

Emerging trends and predictions

Several emerging trends and predictions paint a vivid picture of what the future holds for open banking in the US. These insights offer a glimpse into the innovations and shifts that will define the financial industry in the coming years.

- Increased API sophistication: APIs will become more robust, offering richer data sets and more granular control over data sharing.

- Embedded finance growth: Financial services will increasingly be integrated directly into non-financial platforms, creating frictionless experiences.

- Enhanced security measures: Continuous advancements in cybersecurity and fraud prevention will bolster consumer confidence.

- Regulatory clarity: While not fully harmonized, clearer guidelines will provide a more stable environment for innovation and growth.

The move towards real-time payments and the proliferation of digital wallets will further intertwine with open banking, creating a highly interconnected financial landscape. This integration will offer unprecedented convenience and efficiency for both consumers and businesses.

However, challenges such as data privacy concerns, the need for universal API standards, and equitable access for all financial institutions will persist. Addressing these issues effectively will be crucial for realizing the full potential of open banking and ensuring its widespread, beneficial adoption across the US financial sector.

| Key Aspect | 2025 Outlook |

|---|---|

| Bank Readiness | Varied; large banks advanced, regional/community banks catching up with API investments. |

| Fintech Integration | High; leveraging APIs for innovative products, driving personalized financial experiences. |

| Regulatory Environment | More defined, market-driven with CFPB guidance; focus on consumer data portability. |

| Consumer Trust | Growing, but dependent on transparent data sharing, robust security, and clear consent. |

Frequently asked questions about US open banking

The primary driver for US open banking adoption is a combination of market demand for innovative financial services and evolving consumer expectations for greater control over their financial data. While regulatory guidance is emerging, the impetus largely stems from competitive pressures and technological advancements.

US open banking is primarily market-driven, emphasizing voluntary API adoption and industry collaboration. In contrast, Europe’s PSD2 (Payment Services Directive 2) is a strict regulatory mandate, compelling banks to open their APIs and standardize data sharing, creating a more uniform approach.

Banks face significant challenges including modernizing legacy IT infrastructure, ensuring robust data security, navigating a complex and evolving regulatory environment, and attracting skilled talent in new technology areas. These require substantial investment and strategic planning to overcome.

Fintechs benefit immensely by gaining secure, consent-based access to customer financial data through APIs. This enables them to develop and offer highly personalized, efficient, and innovative products and services, such as budgeting apps, automated investment platforms, and streamlined lending solutions.

Consumer trust is absolutely critical. Without confidence in the security, privacy, and control over their financial data, consumers will be reluctant to participate. Transparent data handling, strong security protocols, and clear consent mechanisms are essential for fostering widespread adoption and success.

Conclusion

By 2025, US Open Banking Adoption is set to redefine the American financial landscape, transitioning from an emerging concept to a more integrated reality. The journey involves a dynamic interplay between traditional banks evolving their digital capabilities and agile fintechs innovating at an unprecedented pace. While challenges such as legacy systems, regulatory clarity, and paramount consumer trust remain, the collaborative synergies between these entities promise a future of enhanced financial services. The ongoing evolution will undoubtedly empower consumers with greater choice and control, pushing the boundaries of what is possible in personal finance and business operations. The outlook points towards a more interconnected, efficient, and user-centric financial ecosystem, shaped by continuous technological advancement and strategic partnerships.