Cloud Security for Fintech: Mitigating Risks & Ensuring Compliance

Cloud security for fintech involves implementing robust strategies to protect sensitive financial data and applications against cyber threats, ensuring regulatory compliance, and maintaining customer trust in the digital financial ecosystem.

In today’s rapidly evolving financial technology (fintech) landscape, cloud computing has become indispensable. However, this reliance on the cloud introduces significant security challenges. This article explores cloud security for fintech, focusing on three essential strategies to mitigate risks and ensure compliance, offering a comprehensive guide for safeguarding your fintech operations in the cloud.

Understanding the Unique Security Challenges in Fintech Cloud Environments

The fintech industry faces unique security challenges due to the sensitive nature of financial data and the stringent regulatory requirements. Understanding these challenges is the first step in developing a robust cloud security strategy.

Fintech companies handle vast amounts of personal and financial information, making them attractive targets for cyberattacks. The cloud environment, while offering scalability and cost-efficiency, also introduces new attack vectors that must be addressed proactively.

Regulatory Compliance in Fintech

Compliance with regulations such as GDPR, PCI DSS, and CCPA is critical for fintech companies. These regulations mandate specific security measures to protect customer data and prevent financial fraud. Cloud security strategies must align with these regulatory requirements to avoid penalties and maintain customer trust.

- GDPR (General Data Protection Regulation): Protects the personal data of EU citizens.

- PCI DSS (Payment Card Industry Data Security Standard): Ensures the secure handling of credit card information.

- CCPA (California Consumer Privacy Act): Grants California residents rights over their personal data.

Meeting these compliance standards requires a multi-faceted approach that includes data encryption, access controls, and regular security audits. Cloud providers often offer tools and services to help fintech companies meet their compliance obligations, but it is ultimately the responsibility of the fintech company to ensure compliance.

In conclusion, understanding the specific security challenges and regulatory requirements in the fintech industry is essential for developing an effective cloud security strategy. By addressing these challenges head-on, fintech companies can protect their data, maintain compliance, and build trust with their customers.

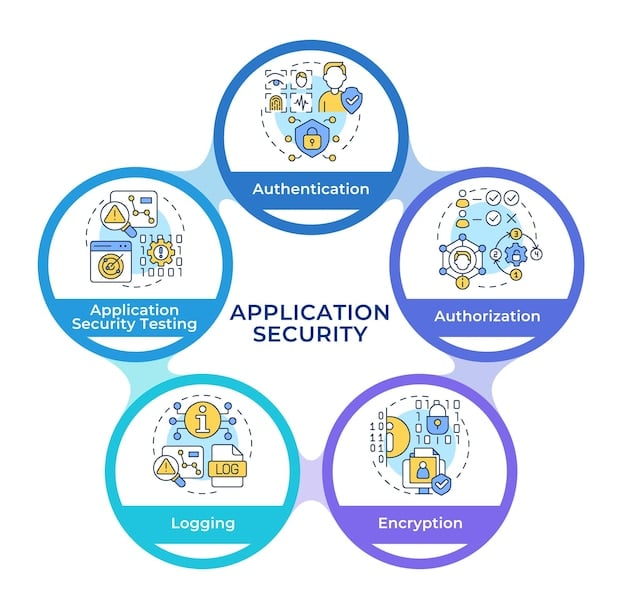

Strategy 1: Implementing Robust Identity and Access Management (IAM)

Identity and Access Management (IAM) is the cornerstone of cloud security for fintech. Implementing a robust IAM strategy ensures that only authorized users have access to sensitive financial data and applications.

IAM involves managing user identities, authenticating users, and controlling their access to resources. A well-designed IAM system can significantly reduce the risk of unauthorized access and data breaches.

Multi-Factor Authentication (MFA)

Multi-Factor Authentication (MFA) adds an extra layer of security by requiring users to provide multiple forms of authentication, such as a password and a one-time code sent to their mobile device. MFA makes it significantly harder for attackers to gain unauthorized access to accounts, even if they manage to steal a password.

- Password: Something the user knows.

- One-Time Code: Something the user has (e.g., a mobile device).

- Biometrics: Something the user is (e.g., a fingerprint).

Implementing MFA across all critical systems and applications is a crucial step in securing cloud environments for fintech. Many cloud providers offer MFA solutions that can be easily integrated into existing IAM systems.

Role-Based Access Control (RBAC)

Role-Based Access Control (RBAC) restricts access to resources based on a user’s role within the organization. RBAC ensures that users only have access to the data and applications they need to perform their job functions, reducing the risk of insider threats and accidental data breaches.

RBAC involves defining roles with specific permissions and assigning users to those roles. This simplifies access management and ensures that users are granted the appropriate level of access based on their responsibilities. Regularly reviewing and updating roles and permissions is essential to maintain the effectiveness of RBAC.

In summary, implementing a robust IAM strategy with MFA and RBAC is essential for cloud security for fintech. By controlling access to sensitive data and applications, fintech companies can significantly reduce the risk of unauthorized access and data breaches, ensuring the confidentiality, integrity, and availability of their data.

Strategy 2: Enhancing Data Protection with Encryption and Key Management

Protecting data at rest and in transit is a fundamental aspect of cloud security for fintech. Encryption and key management are essential tools for achieving this level of data protection.

Encryption involves converting data into an unreadable format, making it impossible for unauthorized users to access sensitive information. Key management involves securely storing and managing the encryption keys used to encrypt and decrypt data.

Data Encryption at Rest and in Transit

Data encryption should be implemented both at rest (when data is stored) and in transit (when data is transmitted between systems). Encrypting data at rest protects it from unauthorized access in the event of a data breach. Encrypting data in transit protects it from eavesdropping and interception during transmission.

- Encryption at Rest: Protects data stored on servers, databases, and storage devices.

- Encryption in Transit: Protects data transmitted over networks, including the internet.

Using strong encryption algorithms and protocols, such as AES-256 and TLS 1.2 or higher, is crucial for ensuring the effectiveness of data encryption. Regularly reviewing and updating encryption algorithms and protocols is essential to stay ahead of evolving threats.

Secure Key Management Practices

Secure key management is critical for protecting encryption keys from unauthorized access and misuse. Key management practices should include generating strong encryption keys, storing keys securely, and rotating keys regularly.

Hardware Security Modules (HSMs) can be used to securely store and manage encryption keys. HSMs are tamper-resistant hardware devices that provide a secure environment for generating, storing, and using encryption keys. Using HSMs is a best practice for protecting encryption keys in cloud environments.

In conclusion, enhancing data protection with encryption and key management is essential for cloud security for fintech. By encrypting data at rest and in transit and implementing secure key management practices, fintech companies can significantly reduce the risk of data breaches and ensure the confidentiality, integrity, and availability of their data.

Strategy 3: Implementing Comprehensive Security Monitoring and Incident Response

Effective security monitoring and incident response are critical for detecting and responding to security incidents in a timely manner. This involves continuously monitoring cloud environments for suspicious activity and having a well-defined incident response plan to address security incidents when they occur.

Security monitoring involves collecting and analyzing security logs, network traffic, and system events to identify potential security threats. Incident response involves taking action to contain, eradicate, and recover from security incidents.

Real-Time Security Monitoring

Real-time security monitoring involves continuously monitoring cloud environments for suspicious activity using Security Information and Event Management (SIEM) tools. SIEM tools collect and analyze security logs from various sources, such as servers, applications, and network devices, to identify potential security threats.

- Log Analysis: Analyzing security logs to identify suspicious patterns and anomalies.

- Network Monitoring: Monitoring network traffic for malicious activity.

- Vulnerability Scanning: Regularly scanning systems for known vulnerabilities.

SIEM tools can be configured to generate alerts when suspicious activity is detected, allowing security teams to respond quickly to potential security incidents. Integrating SIEM tools with threat intelligence feeds can enhance their ability to detect and respond to advanced threats.

Incident Response Planning and Execution

A well-defined incident response plan is essential for effectively responding to security incidents. The incident response plan should outline the steps to be taken when a security incident is detected, including containment, eradication, recovery, and post-incident analysis.

Regularly testing and updating the incident response plan is crucial to ensure its effectiveness. Conducting tabletop exercises and simulations can help security teams practice their incident response skills and identify areas for improvement.

In summary, implementing comprehensive security monitoring and incident response is essential for cloud security for fintech. By continuously monitoring cloud environments for suspicious activity and having a well-defined incident response plan, fintech companies can detect and respond to security incidents in a timely manner, minimizing the impact of security breaches and ensuring the continuity of their business operations.

Best Practices for Maintaining Long-Term Cloud Security in Fintech

Maintaining long-term cloud security in fintech requires ongoing effort and a commitment to continuous improvement. Here are some best practices to help fintech companies maintain a strong security posture in the cloud.

Regularly assessing and updating security controls, staying informed about emerging threats, and fostering a culture of security awareness are essential for long-term cloud security.

Regular Security Assessments and Audits

Conducting regular security assessments and audits is crucial for identifying vulnerabilities and weaknesses in cloud environments. Security assessments should include vulnerability scanning, penetration testing, and code reviews.

Audits should be conducted to ensure compliance with regulatory requirements and industry best practices. Regular security assessments and audits can help fintech companies identify and address security risks before they are exploited by attackers.

Staying Informed About Emerging Threats

Staying informed about emerging threats is essential for adapting security controls to address new risks. This involves monitoring threat intelligence feeds, participating in industry forums, and attending security conferences.

Understanding the latest attack techniques and vulnerabilities can help fintech companies proactively defend against emerging threats and minimize the risk of security breaches.

Creating a Culture of Security Awareness

Creating a culture of security awareness is crucial for ensuring that all employees understand their role in protecting sensitive data and systems. This involves providing regular security training, promoting security best practices, and encouraging employees to report suspicious activity.

A strong security culture can help reduce the risk of insider threats and human error, which are common causes of security breaches.

The Future of Cloud Security in Fintech: Trends and Predictions

The field of cloud security is constantly evolving, and fintech companies must stay ahead of the curve to maintain a strong security posture. Here are some trends and predictions for the future of cloud security in fintech.

Automation, artificial intelligence, and blockchain technology are expected to play increasingly important roles in cloud security for fintech.

Automation of Security Tasks

Automation of security tasks is becoming increasingly important for improving efficiency and reducing human error. This involves using automation tools to automate tasks such as vulnerability scanning, patch management, and incident response.

Automation can help security teams scale their operations and respond more quickly to security incidents.

The Role of Artificial Intelligence (AI) in Security

Artificial Intelligence (AI) is being used to enhance security monitoring and incident response. AI-powered security tools can analyze vast amounts of data to detect anomalies and identify potential security threats that might be missed by human analysts.

AI can also be used to automate incident response tasks, such as isolating infected systems and blocking malicious traffic.

Blockchain for Enhanced Security

Blockchain technology is being explored as a way to enhance security in cloud environments. Blockchain can be used to create tamper-proof audit trails and secure data storage.

Blockchain-based identity management systems can provide a more secure and decentralized way to manage user identities and access controls.

Conclusion

Cloud security for fintech is a multifaceted challenge that requires a comprehensive and proactive approach. By implementing robust IAM, enhancing data protection with encryption, and maintaining continuous security monitoring and incident response, fintech companies can significantly reduce the risk of cyber threats. Embracing emerging technologies like AI and blockchain will further strengthen their security posture in the evolving digital landscape.

| Key Aspect | Brief Description |

|---|---|

| 🛡️ IAM Implementation | Ensuring only authorized users access sensitive data via MFA and RBAC. |

| 🔒 Data Protection | Encrypting data at rest and in transit, with secure key management. |

| 🚨 Security Monitoring | Continuous monitoring for threats, with a robust incident response plan. |

| 🔄 Regular Assessments | Constant evaluation and updates to security controls and procedures. |

FAQ

▼

Cloud security in fintech involves protecting financial data and applications stored in the cloud from unauthorized access, data breaches, and other security threats. It encompasses various strategies and technologies.

▼

IAM ensures that only authorized users can access sensitive data and applications. Implementing practices like MFA and RBAC significantly reduces the risk of unauthorized access and insider threats.

▼

Encryption converts data into an unreadable format, protecting it both at rest and in transit. This prevents unauthorized users from accessing sensitive information, even in the event of a data breach.

▼

Security monitoring involves continuously analyzing security logs, network traffic, and system events to identify and respond to potential security threats in real-time, using tools like SIEM.

▼

Best practices include regular security assessments, staying informed about emerging threats, and fostering a culture of security awareness among employees to minimize risks and human errors.

Conclusion

In conclusion, cloud security for fintech demands a blend of robust methodologies and proactive measures. By prioritizing strong Identity and Access Management, employing comprehensive data encryption, and diligently monitoring for potential threats, fintech companies can navigate the complexities of the cloud while upholding the highest standards of security and compliance. As the industry evolves, embracing automation and AI will be essential for maintaining a secure and trustworthy cloud environment.