Building a Compliant US Fintech Startup: Key Frameworks for 2026

Building a compliant US fintech startup in 2026 necessitates a deep understanding of evolving regulatory landscapes and the implementation of robust frameworks to mitigate risks and avoid significant fines.

Are you navigating the dynamic world of financial technology in the United States? Understanding the critical frameworks for building a compliant US fintech startup in 2026 is not merely a formality; it’s the bedrock of sustainable success and a shield against potentially devastating 7-figure fines. Ignoring these evolving regulations could jeopardize your venture before it even takes flight.

Understanding the Evolving US Regulatory Landscape for Fintech in 2026

The regulatory environment for fintech in the US is a complex and constantly shifting terrain. By 2026, we’ve seen an acceleration in regulatory scrutiny, driven by rapid technological advancements and a heightened focus on consumer protection and financial stability. Fintech startups must not only keep pace but anticipate these changes to build resilient and compliant operations from the ground up.

Navigating this landscape requires more than just legal counsel; it demands a proactive, integrated approach to compliance that permeates every aspect of your business model. The stakes are incredibly high, with non-compliance leading to significant financial penalties, reputational damage, and even operational shutdowns. A strong compliance posture is, therefore, a competitive advantage.

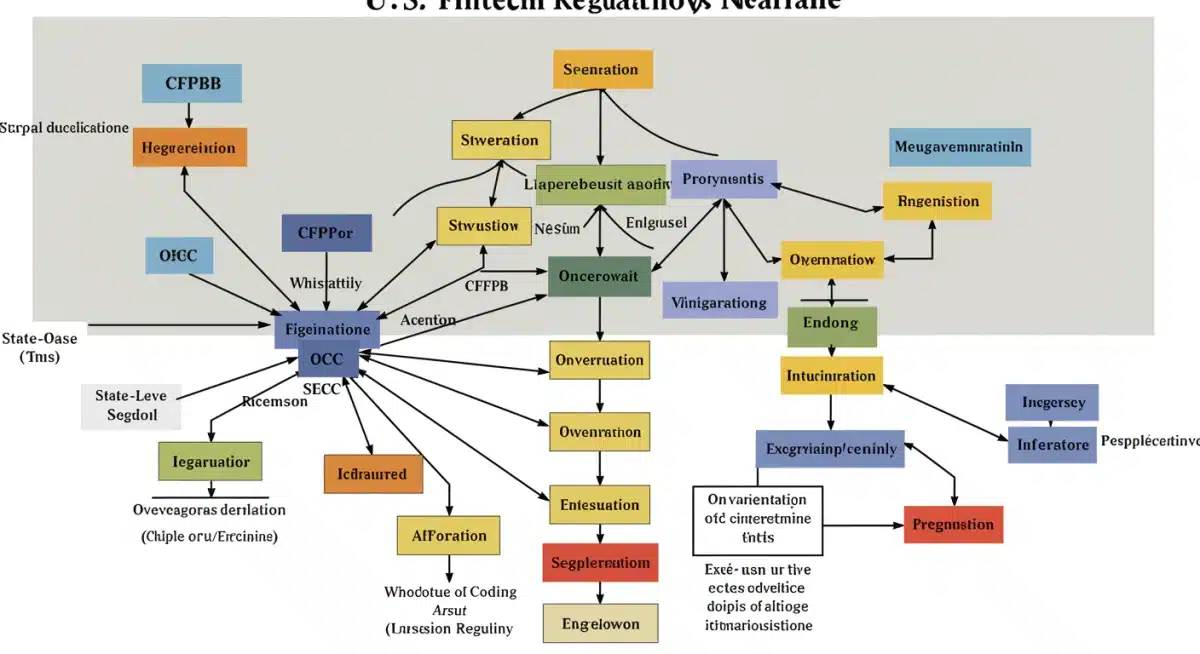

Key Regulatory Bodies and Their Influence

- Consumer Financial Protection Bureau (CFPB): This agency continues to be a primary guardian of consumer rights, focusing on fair lending, data privacy, and transparent practices across all financial products, including those offered by fintechs.

- Securities and Exchange Commission (SEC): For fintechs involved in investment advice, cryptocurrency offerings, or digital asset trading, the SEC’s oversight is paramount, particularly concerning investor protection and market integrity.

- Office of the Comptroller of the Currency (OCC): While often associated with traditional banks, the OCC’s interest in fintech charters and banking-as-a-service models means its influence on bank-fintech partnerships is growing.

Beyond these federal entities, state-level regulations, such as money transmitter licenses or specific state consumer protection laws, add further layers of complexity. Understanding which regulators have jurisdiction over your specific fintech product or service is the first critical step toward compliance. This involves a thorough legal analysis of your business model to identify all applicable laws and regulations, both federal and state.

The regulatory landscape is not static; new interpretations, guidance, and even new legislation are continually emerging. Staying informed through legal updates, industry associations, and dedicated compliance teams is essential for any fintech startup aiming for long-term viability in the US market.

Establishing a Robust Compliance Framework: The Foundation of Trust

A robust compliance framework is the backbone of any successful fintech startup. It moves beyond mere adherence to rules, embedding a culture of ethical conduct and risk awareness throughout the organization. This framework serves as a comprehensive system designed to identify, assess, manage, and monitor compliance risks effectively.

The core components of such a framework typically include strong internal policies, clear procedures, regular training, and continuous monitoring mechanisms. These elements work in concert to ensure that every employee understands their role in maintaining compliance and that the company can adapt quickly to new regulatory demands. Without a well-defined framework, reactive compliance becomes the norm, which is far less efficient and significantly riskier.

Components of an Effective Compliance Program

- Governance and Oversight: This involves establishing clear lines of responsibility, appointing a dedicated Chief Compliance Officer (CCO), and ensuring board-level engagement in compliance matters.

- Risk Assessment: Regularly identifying and evaluating potential compliance risks specific to your fintech’s operations, products, and target markets. This proactive approach helps in allocating resources effectively.

- Policies and Procedures: Developing comprehensive written policies and procedures that translate regulatory requirements into actionable steps for employees. These should cover everything from customer onboarding to data handling.

Crucially, technology plays a pivotal role in modern compliance. Automated compliance tools, AI-powered risk assessment platforms, and robust data management systems can significantly enhance the efficiency and effectiveness of your compliance program. These tools can help monitor transactions, identify suspicious activities, and ensure data integrity, thereby reducing manual effort and human error.

Ultimately, a strong compliance framework is about building trust—with regulators, partners, and, most importantly, your customers. It demonstrates a commitment to responsible innovation and positions your startup as a reliable and secure financial service provider in a competitive market.

Navigating Anti-Money Laundering (AML) and Sanctions Compliance in 2026

Anti-Money Laundering (AML) and sanctions compliance remain critical pillars for any US fintech operating in 2026. The financial intelligence community, led by agencies like the Financial Crimes EnCenforcement Network (FinCEN), continues to intensify its efforts to combat illicit financial activities. Fintechs, with their often-global reach and rapid transaction speeds, are increasingly under the microscope.

Effective AML compliance requires a sophisticated approach that goes beyond basic customer identification. It involves continuous transaction monitoring, robust risk-based assessments, and a deep understanding of global sanctions lists. The penalties for AML and sanctions violations are among the most severe, often reaching into the millions, underscoring the necessity of an ironclad program.

Key Elements of AML and Sanctions Programs

- Customer Identification Program (CIP) and Know Your Customer (KYC): Verifying the identity of customers and understanding the nature of their financial activities to assess risk appropriately. This includes due diligence for beneficial ownership.

- Transaction Monitoring and Suspicious Activity Reporting (SAR): Implementing systems to detect unusual or suspicious transaction patterns and promptly reporting them to FinCEN. This often leverages advanced analytics and AI.

- Sanctions Screening: Regularly screening customers and transactions against lists maintained by the Office of Foreign Assets Control (OFAC) to prevent dealings with sanctioned individuals, entities, or countries.

The technological advancements in fintech also present opportunities for more effective AML. AI and machine learning algorithms can analyze vast amounts of data to identify complex money laundering schemes that might elude traditional rule-based systems. However, these tools must be carefully implemented and regularly audited to ensure accuracy and avoid biases.

Ultimately, a strong AML and sanctions compliance program is not just about avoiding fines; it’s about protecting the integrity of the financial system and preventing your platform from being exploited by criminals. It requires ongoing investment in technology, training, and expertise to stay ahead of evolving threats.

Data Privacy and Cybersecurity: Paramount for Fintech Trust in 2026

In 2026, data privacy and cybersecurity are not merely compliance checkboxes; they are fundamental to earning and maintaining customer trust in the fintech sector. With the exponential growth of data collection and processing, coupled with increasingly sophisticated cyber threats, fintechs are prime targets. Breaches can lead to devastating financial losses, regulatory penalties, and irreparable damage to reputation.

The regulatory landscape for data privacy is also intensifying, with federal laws like the California Consumer Privacy Act (CCPA) and emerging state-level regulations setting higher standards for how personal and financial data must be handled. Fintechs must adopt a comprehensive, layered security approach that protects data at every stage of its lifecycle.

Essential Pillars of Data Security and Privacy

- Data Minimization and Encryption: Collecting only the necessary data and encrypting sensitive information both in transit and at rest to prevent unauthorized access.

- Robust Access Controls: Implementing strict access protocols, multi-factor authentication (MFA), and regular access reviews to ensure only authorized personnel can handle sensitive data.

- Incident Response Plan: Developing and regularly testing a comprehensive plan to detect, respond to, and recover from cybersecurity incidents, including data breaches.

Beyond technical safeguards, a strong emphasis on privacy by design is crucial. This means integrating privacy considerations into the development of every product and service from the outset, rather than as an afterthought. Regular security audits, penetration testing, and employee training on data security best practices are also non-negotiable.

The trust customers place in fintech platforms is directly tied to their confidence that their financial and personal data is secure. Investing heavily in robust cybersecurity infrastructure and adhering to stringent data privacy regulations is an investment in your startup’s future and its ability to thrive in a data-driven financial world.

Consumer Protection and Fair Lending Practices

Consumer protection and fair lending principles are at the heart of US financial regulation, and fintechs are held to increasingly high standards by 2026. The CFPB, among other agencies, meticulously scrutinizes fintech products and services to ensure they are fair, transparent, and do not lead to discriminatory outcomes. This extends to advertising, terms and conditions, and the underlying algorithms used for credit decisions.

Fintechs must ensure their offerings are easily understandable, that fees are clearly disclosed, and that customers have access to effective dispute resolution mechanisms. This commitment to fairness builds consumer confidence and reduces the likelihood of regulatory enforcement actions, which can be costly and damaging.

Key Aspects of Consumer Protection

- Transparency in Pricing and Terms: Clearly communicating all fees, interest rates, and terms of service to consumers, avoiding hidden charges or misleading language.

- Non-Discriminatory Practices: Ensuring that lending algorithms and customer onboarding processes do not result in disparate impact or discriminatory outcomes based on protected characteristics. This often requires rigorous independent audits of AI models.

- Effective Complaint Resolution: Establishing accessible and efficient channels for customers to raise concerns and resolve disputes promptly and fairly.

The use of artificial intelligence and machine learning in lending and financial product offerings presents both opportunities and challenges. While these technologies can enhance efficiency and personalization, they also carry the risk of perpetuating or even amplifying existing biases if not carefully designed and monitored. Regulators are particularly focused on algorithmic fairness and explainability.

Fintechs that prioritize consumer well-being and embed fair lending practices into their core operations will not only meet regulatory expectations but also build a loyal customer base. This proactive approach to consumer protection is a cornerstone of responsible innovation in the financial sector.

Future-Proofing Your Fintech: Adapting to Regulatory Evolution

The regulatory landscape for fintech is not static; it is a continuously evolving ecosystem. For a US fintech startup to thrive in 2026 and beyond, the ability to anticipate and adapt to regulatory changes is paramount. Future-proofing your compliance strategy means building a flexible and agile framework that can incorporate new rules, technologies, and market dynamics without significant disruption.

This requires more than just reactive compliance; it demands a forward-looking perspective, engaging with industry discussions, and even contributing to the development of new regulatory standards. Proactive engagement with regulators can foster a collaborative environment and provide valuable insights into upcoming changes, allowing your startup to prepare effectively.

Strategies for Regulatory Adaptation

- Continuous Regulatory Monitoring: Subscribing to regulatory alerts, participating in industry forums, and maintaining strong relationships with legal and compliance experts to stay abreast of all new developments.

- Flexible Technology Infrastructure: Building systems that can be easily updated or reconfigured to meet new compliance requirements, rather than rigid, monolithic architectures.

- Scenario Planning and Stress Testing: Regularly conducting exercises to assess how potential new regulations or market shifts might impact your compliance posture and business operations.

Investing in regulatory technology (RegTech) solutions is another crucial aspect of future-proofing. RegTech can automate compliance tasks, provide real-time risk assessments, and streamline reporting processes, making it easier for fintechs to adapt to new rules efficiently. These tools can significantly reduce the burden of manual compliance and improve accuracy.

Ultimately, the most successful fintechs in the US will be those that view compliance not as a burden, but as an integral part of their innovation strategy. By embracing regulatory evolution and building adaptable systems, startups can ensure their longevity and continue to deliver groundbreaking financial services responsibly.

| Key Compliance Area | Brief Description |

|---|---|

| Regulatory Landscape | Understanding federal and state oversight, including CFPB, SEC, and OCC, is crucial for operational legality. |

| AML & Sanctions | Implementing robust KYC, transaction monitoring, and OFAC screening to combat financial crime. |

| Data Privacy & Security | Protecting customer data with encryption, access controls, and incident response plans. |

| Consumer Protection | Ensuring transparency, fairness, and non-discriminatory practices in all product offerings. |

Frequently Asked Questions About Fintech Compliance

The primary regulatory bodies include the CFPB for consumer protection, the SEC for investment-related fintechs, and the OCC for those with banking charters or partnerships. State-level financial regulators also play a significant role, particularly for money transmission services, adding layers of specific compliance requirements.

Effective AML and sanctions compliance involves robust KYC/CIP procedures, continuous transaction monitoring using advanced analytics, and diligent screening against OFAC sanctions lists. Regular training for staff and leveraging RegTech solutions can significantly enhance these efforts, mitigating the risk of financial crime.

Privacy by design is an approach where data protection and privacy considerations are integrated into the entire engineering process of products and services from the very beginning. For fintechs, it’s crucial because it ensures customer data is secure by default, fostering trust and meeting stringent data privacy regulations like CCPA.

Fintechs ensure fair lending with AI by conducting rigorous audits of their algorithms to identify and mitigate biases, ensuring transparency in decision-making, and adhering to non-discrimination laws. Regular monitoring and explainable AI (XAI) techniques help maintain ethical and compliant lending practices, avoiding disparate impacts on protected groups.

RegTech solutions are vital for future-proofing compliance by automating regulatory tasks, providing real-time risk assessments, and streamlining reporting. They enable fintechs to adapt quickly to evolving regulations, reduce human error, and manage complex compliance requirements more efficiently, ensuring agility in a dynamic regulatory environment.

Conclusion

Building a compliant US fintech startup in 2026 is an intricate yet indispensable endeavor. The regulatory landscape demands perpetual vigilance, proactive strategy, and a deep-seated commitment to ethical practices. By meticulously understanding federal and state frameworks, establishing robust AML and sanctions programs, prioritizing data privacy and cybersecurity, and upholding consumer protection principles, fintechs can not only avoid punitive fines but also cultivate invaluable trust. Ultimately, compliance is not merely a legal obligation; it is a strategic imperative that underpins innovation, fosters sustainable growth, and secures a reputable position in the competitive US financial technology market.