Fintech Startup Partnerships: Navigating Collaboration with Banks

Fintech startup partnerships with banks and financial institutions involve strategic alliances to leverage innovation and resources, requiring careful planning, due diligence, and a shared vision for success.

Navigating the fintech landscape often requires strategic alliances, and partnerships between fintech startup partnerships and established banks or financial institutions can be mutually beneficial. These collaborations allow startups to access resources and market reach, while banks can leverage innovative technologies and solutions to enhance their offerings.

Understanding the Fintech Partnership Ecosystem

The fintech ecosystem is dynamic, with startups constantly emerging and existing financial institutions seeking to stay competitive. Partnerships form a critical bridge in this environment, enabling both parties to achieve goals they couldn’t reach independently.

These partnerships take various shapes, from simple referral agreements to complex joint ventures. Understanding the different types and their potential benefits is crucial for any fintech startup considering collaboration.

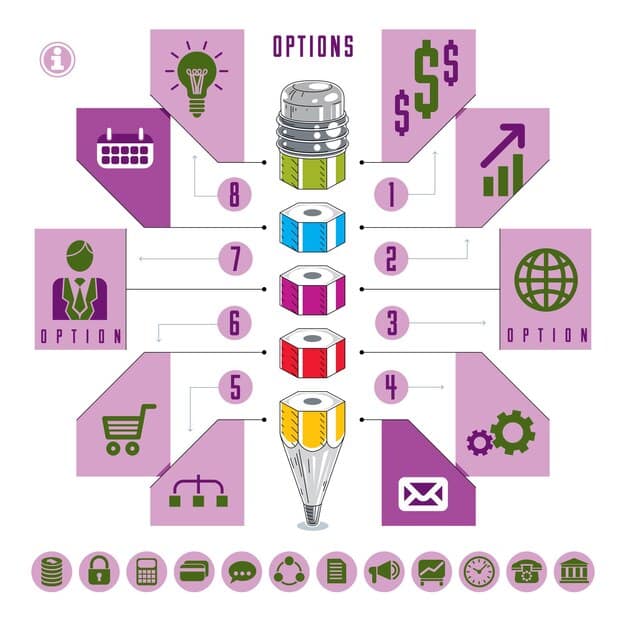

Types of Fintech Partnerships

Exploring the types of partnerships available can help startups determine the best fit for their specific needs and goals.

- Technology Integration: Banks integrate fintech solutions into their existing platforms.

- Joint Ventures: New entities created collaboratively to offer specific products or services.

- Referral Agreements: Startups refer customers to banks, or vice versa.

- Investment Partnerships: Banks invest directly in fintech startups.

Each type presents unique opportunities and challenges, influencing the overall success and long-term impact of the collaboration.

Ultimately, understanding the fintech partnership ecosystem starts with recognizing the value that each player brings to the table. Banks bring experience, compliance expertise, and capital, while fintech startups offer agility, disruptive technologies, and innovative business models. The intersection of these strengths forms the bedrock of fruitful alliances.

Benefits for Fintech Startups

Fintech startups often face hurdles in scaling their business, gaining market access, and securing funding. Strategic partnerships address these challenges, providing tangible benefits that contribute to sustainable growth.

Partnering with established financial institutions offers startups access to a broader customer base, compliance support, and the credibility that established brands provide.

Key Advantages of Partnering

Unlocking the benefits requires a well-defined strategy and clear understanding of the value proposition for both parties.

- Accelerated Growth: Access to a bank’s customer base can rapidly scale user adoption.

- Enhanced Credibility: Association with an established brand builds trust.

- Funding Opportunities: Partnerships often lead to investment from the financial institution.

- Regulatory Guidance: Banks provide expertise navigating compliance requirements.

Careful consideration of these factors can position a startup for success in the competitive fintech landscape.

In essence, by understanding and leveraging these benefits, fintech startups can ensure that partnerships are not just beneficial for gaining immediate resources, but also for building a robust, sustainable foundation for long-term success.

Benefits for Banks and Financial Institutions

While fintech startups gain access to resources and market reach through partnerships, banks and financial institutions also stand to benefit significantly from these collaborations. Partnerships can help them innovate faster, enhance customer experiences, and stay ahead of the competition.

Banks gain access to cutting-edge technology, agile development practices, and innovative business models. Fintech startups can inject new ideas and approaches into established institutions.

Staying Competitive in the Digital Age

The competitive landscape demands that banks continuously improve their services and adopt new technologies.

- Faster Innovation: Access to new technologies without lengthy internal development.

- Improved Customer Experience: Enhanced digital offerings and personalized services.

- Cost Savings: Streamlined processes and reduced operational expenses.

- Talent Acquisition: Attracting skilled professionals through exposure to innovative projects.

Aligning strategic goals and embracing change are pivotal for banks seeking to lead in digital transformation.

Ultimately, smart banks are recognizing that collaboration isn’t just about keeping up; it’s about leading the way. By strategically partnering with fintech startups, they not only access new technologies but also gain fresh perspectives and agile methodologies that can revitalize their operations from the inside out.

Navigating the Partnership Process

Establishing a successful partnership requires a structured process, starting with identifying the right partner, conducting due diligence, and clearly defining the terms of the agreement.

Careful planning and open communication are essential for ensuring that both parties are aligned and working towards common goals. The process involves several critical steps.

Key Steps to a Successful Partnership

Following a step-by-step approach increases the likelihood of a fruitful and lasting collaboration.

- Identify Potential Partners: Seek partners with complementary strengths and shared values.

- Due Diligence: Thoroughly assess the partner’s business, financials, and compliance.

- Negotiation and Agreement: Clearly define roles, responsibilities, and financial terms.

- Implementation and Integration: Seamlessly integrate technologies and processes.

Diligent execution and ongoing management are crucial for realizing the full potential of the partnership.

In summary, understanding and systematically navigating the partnership process can significantly increase the likelihood of a beneficial relationship, where both fintech startups and financial institutions can effectively leverage each other’s strengths to achieve mutual success.

Challenges and Risks of Fintech Partnerships

While fintech partnerships offer numerous benefits, they also come with inherent challenges and risks that need to be carefully managed. Understanding these potential pitfalls is crucial for mitigating negative outcomes and ensuring the partnership’s success.

Challenges include managing cultural differences, ensuring regulatory compliance, and aligning strategic goals. Risk assessment is a crucial part of the process.

Mitigating Potential Pitfalls

Effective risk management is essential for sustaining a healthy partnership.

- Cultural Differences: Address disparities in organizational culture and communication styles.

- Regulatory Compliance: Ensure the partnership adheres to all applicable laws and regulations.

- Data Security: Implement robust measures to protect sensitive data.

Proactive management and adaptable strategies can transform challenges into opportunities for growth.

In conclusion, the key to navigating these challenges lies in foresight, open communication, and a commitment to building a resilient partnership. By proactively addressing potential risks, both fintech startups and financial institutions can maximize the benefits of their collaboration while minimizing the chances of failure.

Best Practices for Collaboration

Adopting best practices for collaboration is essential for maximizing the value and impact of fintech partnerships. These practices foster trust, transparency, and mutual respect between the partners.

Clear communication, well-defined roles, and shared goals are fundamental for successful collaboration. Regular communication is vital.

Effective Communication Strategies

Establishing clear channels of communication is critical for building trust and transparency.

- Regular Meetings: Schedule frequent meetings to discuss progress and address issues.

- Open Communication: Encourage open and honest dialogue between teams.

- Defined Roles: Clearly outline roles and responsibilities for each party.

Consistently applying these strategies will strengthen the partnership and drive collective success.

Ultimately, fintech partnerships hinge on more than just business deals; they depend on the fostering of genuine, collaborative relationships. By focusing on clear communication, building trust, and aligning goals, both fintech startups and financial institutions can forge partnerships that are truly transformative.

| Key Point | Brief Description |

|---|---|

| 🤝 Partnership Value | Strategic alliances benefit both fintech startups and established financial institutions. |

| 🚀 Startup Advantages | Startups gain market access, funding, and credibility through these collaborations. |

| 🏦 Bank Benefits | Banks enhance innovation, improve customer experience, and stay competitive. |

| ⚠️ Partnership Risks | Challenges include cultural differences, compliance, and data security; risk mitigation is vital. |

FAQ

The main types include technology integration, joint ventures, referral agreements, and investment partnerships, each offering unique collaboration opportunities.

Startups can gain access to broader customer bases, enhanced credibility, funding opportunities, and regulatory guidance through partnerships.

Banks can achieve faster innovation, improved customer experiences, cost savings, and access to cutting-edge technologies through these alliances.

Key challenges include cultural differences between organizations, ensuring data security, and maintaining adherence to regulatory compliance.

Best practices include establishing regular meetings, encouraging open communication, defining clear roles, and fostering transparency to build trust.

Conclusion

In conclusion, fintech startup partnerships represent a powerful avenue for innovation and growth in the financial industry. By carefully navigating the partnership process, managing risks effectively, and adopting best practices for collaboration, both startups and established institutions can unlock significant value and drive meaningful change in the financial landscape.