Integrate Digital Payments: A US E-commerce Guide

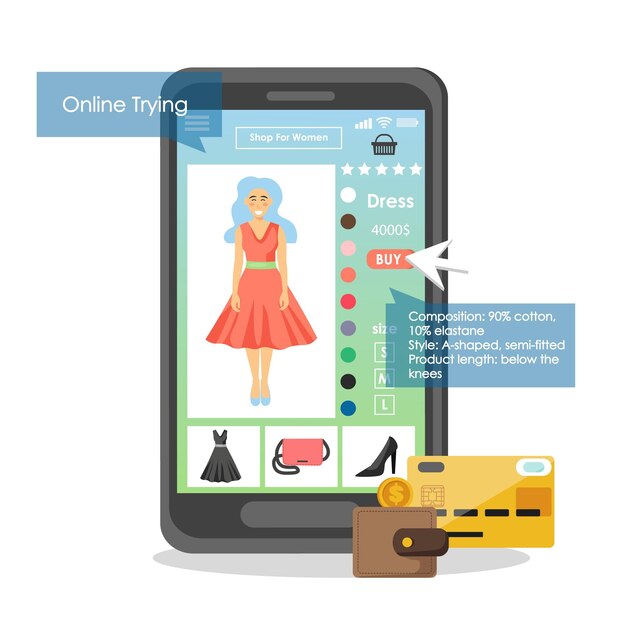

Integrating digital payment options into your US e-commerce platform is crucial for enhancing customer experience, increasing sales, and staying competitive in today’s market, offering a variety of methods from credit cards to mobile wallets.

Integrating digital payment options into your US e-commerce platform: A practical guide significantly enhances customer satisfaction and boosts sales by providing a seamless and secure payment experience tailored to modern shoppers.

Understanding the US Digital Payment Landscape

The digital payment landscape in the US is rapidly evolving, driven by technological advancements and changing consumer preferences. E-commerce businesses need to understand these trends to remain competitive.

From mobile wallets to cryptocurrency, various payment methods are gaining traction. Understanding which options resonate most with your target audience is crucial for driving conversions and fostering customer loyalty.

Key Digital Payment Trends in the US

Keeping abreast of the newest trends is essential for staying ahead in the e-commerce payment sector. Here’s what’s shaping the future of digital payments in the US:

- Mobile Wallets: Adoption of mobile wallets like Apple Pay and Google Pay is increasing due to their convenience and security.

- Buy Now, Pay Later (BNPL): BNPL services are attracting younger demographics by offering flexible payment plans.

- Cryptocurrencies: While still niche, accepting cryptocurrencies can attract tech-savvy customers and offer potential cost savings.

Understanding these trends will help you select the most appropriate payment options for your e-commerce platform, ensuring that you meet customer expectations and maximize sales.

Staying informed about these critical trends ensures that your business can adapt quickly, providing customers with payment options they trust and prefer, thereby enhancing their overall shopping experience.

Choosing the Right Payment Gateway

Selecting the right payment gateway is a critical step in integrating digital payment options. A payment gateway acts as an intermediary between your e-commerce platform and the customer’s bank, facilitating secure transactions.

With numerous gateways available, evaluating factors such as transaction fees, security features, and integration ease is crucial. A well-chosen gateway ensures smooth, secure, and cost-effective payment processing.

Factors to Consider When Choosing a Payment Gateway

Several factors should influence your choice of payment gateway. Here are some key considerations:

- Transaction Fees: Understand the fee structure, including per-transaction fees, monthly fees, and any hidden costs.

- Security Features: Ensure the gateway complies with PCI DSS standards and offers robust fraud protection.

- Integration Ease: The gateway should integrate seamlessly with your e-commerce platform to avoid technical issues.

By carefully considering these factors, you can select a payment gateway that aligns with your business needs and enhances the payment experience for your customers.

Choosing prudently ensures that the monetary gateway meets all operational requirements as well as provides the best possible customer payment experience which in turn will increase revenue.

Implementing Credit and Debit Card Payments

Credit and debit cards remain the most popular payment methods for online transactions. Integrating these options seamlessly is essential for any e-commerce platform.

Ensuring a secure and user-friendly experience for card payments requires partnering with reliable payment processors. This process involves setting up merchant accounts and complying with stringent security standards to protect customer data.

Best Practices for Card Payment Integration

To provide a seamless and secure card payment experience, consider the following best practices:

By adhering to these practices, you minimize risks and enhance customer trust, which can directly translate into increased sales and customer retention.

- Use Tokenization: Replace sensitive card data with tokens to reduce the risk of data breaches.

- Implement 3D Secure: Add an extra layer of security by verifying the cardholder’s identity with their bank.

- Optimize Checkout Flow: Streamline the checkout process to minimize friction and reduce cart abandonment.

Implementing credit and debit card payments effectively not only boosts customer confidence but also supports higher transaction volumes, ensuring a solid foundation for your e-commerce operations.

Integrating Mobile Wallet Payments

Mobile wallets like Apple Pay, Google Pay, and Samsung Pay are gaining popularity due to their convenience and security. Integrating these options can attract tech-savvy customers.

Offering mobile wallet payments involves working with payment gateways that support these methods. The integration often simplifies the checkout process for mobile users, reducing cart abandonment rates and enhancing customer satisfaction.

Benefits of Accepting Mobile Wallets

- Faster Checkout: Customers can complete transactions with a single tap, reducing friction.

- Enhanced Security: Mobile wallets use tokenization and biometric authentication for added security.

- Wider Reach: Attract younger, tech-savvy customers who prefer mobile payment options.

Incorporating mobile wallet integration into your application provides your customers with a fast and secure payment process which enhances customer loyalty and facilitates sales.

Accepting mobile wallets not only boosts transaction speed and security but also aligns your business with the latest consumer trends, ensuring you capture a broader audience in the competitive e-commerce market.

Leveraging Buy Now, Pay Later (BNPL) Services

Buy Now, Pay Later (BNPL) services have become increasingly popular, particularly among younger consumers. BNPL allows customers to make purchases and pay for them in installments, often without interest.

Integrating BNPL options can increase sales by making products more accessible. However, it’s important to understand the associated fees and risks, both for your business and your customers.

Best Practices for Offering BNPL

- Choose Reputable Providers: Partner with well-known BNPL services to ensure credibility and security.

- Disclose Fees Clearly: Be transparent about any fees or interest rates associated with BNPL.

- Educate Customers: Provide information on how BNPL works and the responsibilities involved.

Including the BNPL service as a payment option can increase sales and improve the customer experience however, you should select a credible provider, disclose the details transparently to your customers and train your customers on how to use BNPL responsibly.

These practices help guarantee that customers are well informed and able to make decisions that boost conversion rates while reducing the danger of missed payments, hence adding to the growth and reliability of your company’s e-commerce system.

Security and Compliance Considerations

Security and compliance are paramount when integrating digital payment options. E-commerce businesses must protect customer data and comply with industry standards to maintain trust.

Implementing robust security measures, such as encryption and tokenization, is essential. Additionally, staying compliant with PCI DSS and other regulations helps you avoid penalties and maintain a secure payment environment.

Essential Security Measures for Digital Payments

- PCI DSS Compliance: Adhere to the Payment Card Industry Data Security Standard to protect cardholder data.

- Encryption: Use encryption protocols like SSL/TLS to secure data transmitted between your platform and payment gateways.

- Fraud Prevention Tools: Implement fraud detection and prevention tools to identify and block suspicious transactions.

Prioritizing security and compliance not only protects your customers but also safeguards your business from potential financial losses and reputational damage, building a solid foundation for sustainable growth.

Through strict adherence to safety requirements and proactive measures, companies improve their clients’ payment experience, which strengthens consumer confidence and supports long-term e-commerce success.

| Key Point | Brief Description |

|---|---|

| 💳 Payment Gateways | Choose secure, PCI DSS-compliant gateways for reliable transactions. |

| 📱 Mobile Wallets | Integrate options like Apple Pay & Google Pay for faster checkouts. |

| 💰 BNPL Services | Offer flexible payment plans with clear fee disclosures. |

| 🔒 Security | Implement encryption and fraud prevention tools for data protection. |

FAQ

▼

A payment gateway is a service that authorizes credit card or direct payments processing for e-businesses and online retailers, ensuring secure transactions.

▼

Offering multiple payment options caters to diverse customer preferences, increasing conversion rates and improving customer satisfaction by providing flexibility.

▼

Ensure PCI DSS compliance by using certified payment gateways, implementing encryption, and regularly updating security protocols to protect cardholder data.

▼

Mobile wallet integration offers faster checkout, enhanced security through tokenization, and attracts tech-savvy customers, improving the overall shopping experience.

▼

BNPL can be beneficial but assess if your customer base desires it and understand fees. Ensure you partner with reputable BNPL providers for security.

Conclusion

Integrating diverse digital payment options is vital for US e-commerce platforms to meet evolving consumer demands and stay competitive. By carefully selecting payment gateways, implementing robust security measures, and offering convenient options like mobile wallets and BNPL, businesses can enhance customer satisfaction and drive sales growth.