Mobile Banking in the US: Fintechs vs Traditional Banks

Mobile banking in the US is undergoing a revolution, with fintech companies challenging traditional banks by offering innovative and user-friendly services that are rapidly gaining popularity among consumers.

The landscape of mobile banking in the US is rapidly evolving. Fintech companies are stepping up, offering innovative solutions that are not just competing with but often surpassing traditional banks in attracting customers. This shift is reshaping how Americans manage their finances.

The Rise of Mobile Banking in the US

Mobile banking has transformed how Americans interact with their finances. Smartphones have become essential tools. They allow users to manage their accounts, pay bills, and transfer funds from anywhere. This convenience has fueled massive adoption, with a growing number of consumers preferring mobile banking over traditional brick-and-mortar branches.

Fintech companies are at the forefront of this shift, driving innovation and setting new standards for user experience. Their agility and customer-centric approach are forcing traditional banks to adapt or risk falling behind. This competition is ultimately benefiting consumers, who now have access to a wider range of mobile banking options.

Key Drivers of Mobile Banking Adoption

Several factors are contributing to the rapid adoption of mobile banking in the US. These drivers include convenience, accessibility, and the increasing comfort level of consumers with using technology for financial services.

- Convenience: Mobile banking offers unparalleled convenience, allowing users to manage their finances 24/7 from anywhere with an internet connection.

- Accessibility: Smartphones have become ubiquitous, making mobile banking accessible to a wide range of consumers, including those in underserved communities.

- User Experience: Fintech companies are investing heavily in user-friendly interfaces and intuitive features, making mobile banking more appealing to consumers.

- Security: Advanced security measures, such as biometric authentication and fraud detection tools, are building trust in mobile banking.

The rise of mobile banking reflects a broader trend towards digital transformation in the financial services industry. Consumers are increasingly demanding seamless, personalized, and convenient financial experiences. Fintech companies are well-positioned to meet these demands, driving further growth in mobile banking adoption.

How Fintechs are Disrupting Traditional Banking

Fintech companies are disrupting traditional banking by offering innovative and customer-centric mobile banking solutions. These challengers are leveraging technology to provide superior user experiences, lower fees, and more personalized services. These aspects are attracting a significant portion of the market.

Unlike traditional banks, which often struggle with legacy systems and bureaucratic processes, fintechs can quickly adapt to changing market conditions and customer preferences. This agility gives them a competitive edge and allows them to experiment with new features and technologies.

Key Innovations by Fintech Companies

Fintech companies are introducing a range of innovations that are transforming the mobile banking experience. These innovations include AI-powered chatbots, personalized financial advice, and seamless integration with other financial services.

- AI-Powered Chatbots: Fintech apps use AI to provide instant customer support and answer frequently asked questions, improving customer satisfaction.

- Personalized Financial Advice: Many fintechs offer personalized financial advice based on user spending habits and financial goals, helping customers make smarter financial decisions.

- Seamless Integration: Fintech apps often integrate with other financial services, such as investment platforms and budgeting tools, providing a holistic view of a user’s finances.

By focusing on user experience and leveraging the latest technologies, fintechs are setting new standards for mobile banking. They have forced traditional banks to modernize their offerings and improve their customer service.

Traditional Banks Response to the Fintech Challenge

Traditional banks are not standing still in the face of the fintech challenge. They are investing heavily in technology, modernizing their mobile banking apps, and partnering with fintech companies to offer new products and services. This creates a more competitive landscape.

Many traditional banks are adopting a hybrid approach, combining their existing infrastructure and customer base with fintech innovations. This allows them to offer a wider range of services while maintaining the trust and security that customers associate with traditional banking.

Strategies Employed by Traditional Banks

Traditional banks are employing several strategies to compete with fintech companies in the mobile banking space. These strategies include upgrading their technology infrastructure, improving their user experience, and offering more personalized services.

- Technology Upgrades: Banks are investing in modernizing their IT infrastructure to support new features and improve the performance of their mobile banking apps.

- User Experience Improvements: Banks are redesigning their mobile banking apps to be more user-friendly and intuitive, incorporating elements from successful fintech apps.

- Partnerships with Fintechs: Banks are partnering with fintech companies to offer innovative products and services, such as digital wallets and peer-to-peer payment platforms.

While traditional banks may not be as agile as fintechs, they have the advantage of a large customer base and established brand recognition. By leveraging these strengths and embracing innovation, they can remain competitive in the mobile banking market.

Security and Trust in Mobile Banking

Security and trust are critical factors in the adoption of mobile banking. Consumers need to feel confident that their personal and financial information is safe when using mobile banking apps. Both fintechs and traditional banks are investing heavily in security measures to protect their customers.

Advanced security technologies, such as biometric authentication, fraud detection systems, and encryption, are becoming standard features in mobile banking apps. These technologies help to prevent fraud, protect against cyberattacks, and ensure the privacy of user data.

Key Security Measures in Mobile Banking

Several key security measures are employed to protect mobile banking users. These measures include multi-factor authentication, biometric verification, and real-time fraud monitoring.

- Multi-Factor Authentication: This requires users to provide multiple forms of identification, such as a password and a one-time code sent to their mobile phone, to access their accounts.

- Biometric Verification: Fingerprint and facial recognition technology are used to verify the identity of users and prevent unauthorized access to their accounts.

- Real-Time Fraud Monitoring: Banks and fintechs use sophisticated algorithms to detect suspicious transactions and prevent fraud in real-time.

By prioritizing security and building trust, mobile banking providers can encourage greater adoption and ensure the long-term success of their platforms. Clear communication and transparency about security measures are also essential for building consumer confidence.

The Future of Mobile Banking

The future of mobile banking is looking bright, with continued innovation and growth expected in the coming years. As technology evolves and consumer preferences change, the mobile banking experience will become even more seamless, personalized, and integrated with other aspects of daily life.

Emerging technologies, such as blockchain and artificial intelligence, have the potential to further transform mobile banking. These technologies could enable new features, such as decentralized finance (DeFi) services and AI-powered financial assistants.

Emerging Trends in Mobile Banking

Several emerging trends are shaping the future of mobile banking. These trends include the rise of embedded finance, the growing importance of personalization, and the increased use of mobile wallets.

- Embedded Finance: Mobile banking services are being integrated into non-financial apps and platforms, allowing users to manage their finances within the context of their everyday activities.

- Personalization: Mobile banking apps are becoming more personalized, offering tailored recommendations and insights based on user data and preferences.

- Mobile Wallets: The use of mobile wallets for payments is increasing, with more consumers using their smartphones to make purchases in-store and online.

As mobile banking continues to evolve, it will play an increasingly important role in the financial lives of consumers. Fintechs and traditional banks will need to adapt to these changes and continue to innovate to meet the evolving needs of their customers.

Winning Over Customers: User Experience and Personalization

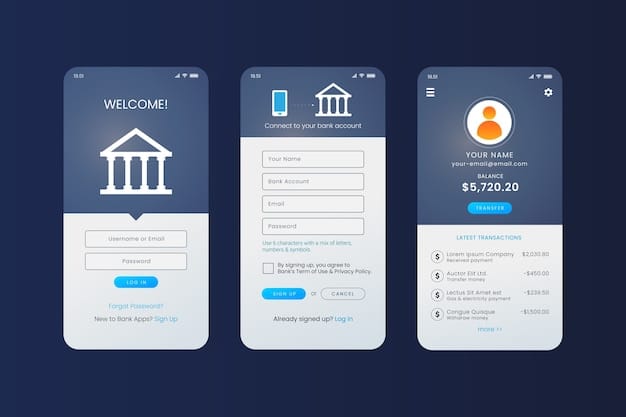

In the competitive landscape of mobile banking, user experience and personalization are key differentiators. Fintechs and traditional banks are focusing on creating intuitive, seamless, and personalized experiences to attract and retain customers. A superior user experience can significantly impact customer satisfaction.

Customers expect mobile banking apps to be easy to use, visually appealing, and responsive. They also want access to personalized features and insights that help them manage their finances more effectively. Companies that can deliver on these expectations are more likely to succeed in the mobile banking market.

Strategies for Enhancing User Experience

Several strategies can be employed to enhance the user experience of mobile banking apps. These strategies include simplifying the user interface, providing personalized support, and offering value-added services.

- Simplified User Interface: Mobile banking apps should be designed with simplicity in mind, making it easy for users to navigate and access the features they need.

- Personalized Support: Providing personalized support through chatbots or live agents can help customers resolve issues quickly and efficiently.

- Value-Added Services: Offering value-added services, such as budgeting tools and financial education resources, can enhance the overall user experience.

| Key Point | Brief Description |

|---|---|

| 📱 Mobile Banking Rise | Smartphones offer convenience in managing finances. |

| 💡 Fintech Disruption | Fintechs innovate with user-friendly, low-fee services. |

| 🏦 Traditional Response | Banks modernize apps and partner with fintechs. |

| 🔒 Security Priority | Advanced measures build trust in mobile banking. |

Frequently Asked Questions (FAQ)

▼

Mobile banking allows users to perform financial transactions using a mobile device such as a smartphone or tablet. This includes activities like checking balances, transferring funds, and paying bills.

▼

Mobile banking is generally secure, employing technologies like encryption, biometric authentication, and multi-factor authentication to protect user data and prevent unauthorized access.

▼

Mobile banking offers convenience, accessibility, and time-saving benefits. It allows users to manage their finances anytime, anywhere, without needing to visit a physical bank branch.

▼

Fintech companies compete by offering more user-friendly interfaces, lower fees, and innovative features. They leverage technology to provide a superior mobile banking experience compared to traditional banks.

▼

The future of mobile banking involves greater personalization, integration with other financial services, and the adoption of emerging technologies like AI and blockchain to enhance user experience and security.

Conclusion

The transformation of mobile banking in the US is a dynamic process, with fintech companies leading the charge in innovation and customer-centric solutions. Traditional banks are adapting, creating a competitive environment that ultimately benefits consumers through improved services and enhanced accessibility. As technology continues to evolve, the future of mobile banking in the US promises even greater convenience, personalization, and security for all users.