Reduce Fintech Startup CAC by 15% in 3 Months: Proven Strategies

Fintech Startup Customer Acquisition Cost (CAC) significantly impacts profitability; reducing it by 15% in three months involves optimizing marketing spend, refining customer targeting, and enhancing user experience for sustainable growth and improved ROI.

For fintech startups, managing the Fintech Startup Customer Acquisition Cost: How to Reduce It by 15% in 3 Months effectively is essential for sustainable growth and profitability. Understanding and optimizing CAC can be a game-changer.

Understanding Fintech Startup Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) is a critical metric for any business, but it holds particular significance for fintech startups. In a competitive landscape, understanding and managing CAC effectively can be the difference between success and failure.

Let’s delve into what CAC means for fintech startups.

What is Customer Acquisition Cost?

Customer Acquisition Cost (CAC) represents the total expenses incurred to acquire a new customer. This includes marketing expenses, sales salaries, advertising costs, and any other costs directly attributed to attracting and converting prospects into paying customers.

Why CAC Matters for Fintech Startups

CAC is a key indicator of a fintech startup’s efficiency in acquiring customers. A high CAC can erode profit margins and hinder growth, while a low CAC indicates efficient marketing and sales strategies. Monitoring CAC helps startups optimize their spending and improve overall profitability.

- Sustainability: High CAC can make a business unsustainable in the long run.

- Investment: Investors often look at CAC to assess a startup’s potential for scalability.

- Profitability: Reducing CAC directly improves profitability and cash flow.

Controlling CAC is essential for long-term success.

In conclusion, understanding and actively managing CAC is fundamental for fintech startups. By focusing on strategies to reduce this cost, startups can achieve greater profitability, attract investment, and ensure long-term sustainability.

Analyzing Your Current CAC

Before implementing strategies to reduce your Fintech Startup Customer Acquisition Cost: How to Reduce It by 15% in 3 Months, it is vital to accurately calculate and analyze your current CAC. This involves identifying all relevant costs and understanding the nuances of customer acquisition in the fintech sector.

Let’s look at how to conduct a thorough analysis.

Calculating Your Current CAC

The basic formula for calculating CAC is simple: Divide the total costs associated with acquiring new customers by the number of customers acquired during a specific period. This includes all marketing and sales expenses.

CAC = Total Marketing and Sales Expenses / Number of New Customers Acquired

Identifying All Relevant Costs

Ensure all costs are accounted for, including online advertising, content marketing, sales salaries, marketing software, and any incentives offered to acquire customers. Overlooking any cost can lead to an inaccurate CAC calculation.

Tools and Technologies for Tracking CAC

Utilize analytics tools, CRM systems, and marketing automation platforms to track and attribute costs accurately. These tools provide insights into which marketing channels are most effective and where costs can be optimized.

- Google Analytics: Track website traffic and conversion rates.

- CRM Systems (e.g., Salesforce): Manage customer interactions and sales pipelines.

- Marketing Automation Platforms (e.g., HubSpot): Automate marketing tasks and track campaign performance.

Analyzing your CAC is crucial.

In summary, accurately calculating and analyzing your current CAC is the foundation for implementing effective cost-reduction strategies. By identifying all relevant costs and leveraging the right tools, fintech startups can gain valuable insights into their customer acquisition processes and pave the way for significant improvements.

Optimizing Marketing Spend for Lower CAC

One of the most direct ways to impact your Fintech Startup Customer Acquisition Cost: How to Reduce It by 15% in 3 Months is by optimizing your marketing spend. This involves refining your marketing strategies, focusing on high-ROI channels, and continually testing and iterating.

Let’s look at how to optimize where your marketing dollars are going.

Refining Your Marketing Strategies

Evaluate the effectiveness of your current marketing channels. Focus on those that yield the highest conversion rates and ROI. This might involve shifting budget away from underperforming channels to those that are more successful.

Leveraging Content Marketing

Create valuable and engaging content that attracts potential customers and establishes your fintech startup as an authority in the industry. Content marketing can include blog posts, whitepapers, webinars, and infographics.

Improving SEO and Organic Reach

Optimize your website and content for search engines to increase organic traffic. This includes keyword research, on-page optimization, and building high-quality backlinks. Organic traffic is a cost-effective way to attract new customers.

- Targeted Content: Create content addressing specific customer pain points.

- Keyword Research: Identify high-value keywords with lower competition.

- Backlink Building: Secure backlinks from reputable websites in your industry.

Optimizing marketing spend is key.

In conclusion, optimizing marketing spend is a crucial step toward reducing CAC. By refining marketing strategies, leveraging content marketing, and improving SEO, fintech startups can attract more customers at a lower cost, thereby improving profitability and sustainability.

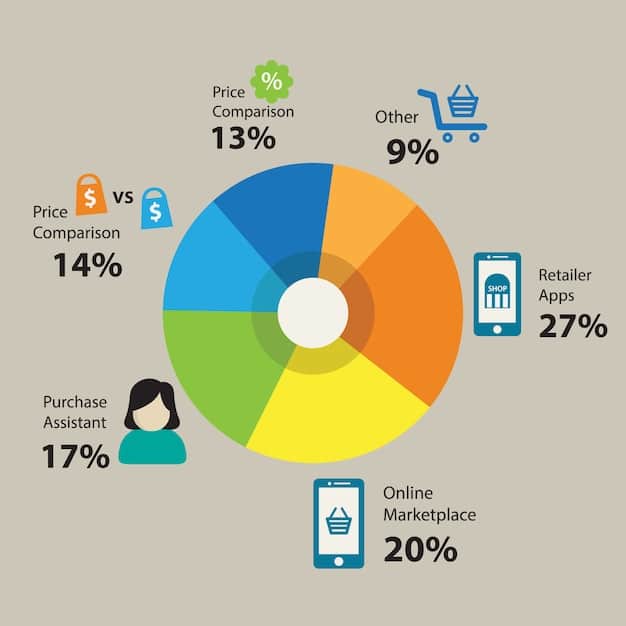

Refining Your Customer Targeting and Segmentation

Effective customer targeting and segmentation are essential components of reducing your Fintech Startup Customer Acquisition Cost: How to Reduce It by 15% in 3 Months. By understanding your audience better, you can tailor your marketing efforts to reach the most receptive prospects.

Let’s discuss how to refine your targeting.

Identifying Your Ideal Customer Profile

Develop a detailed profile of your ideal customer, including demographics, psychographics, and behavioral traits. This will help you focus your marketing efforts on the most promising leads.

Segmenting Your Customer Base

Divide your customer base into distinct segments based on shared characteristics. This allows you to create targeted marketing campaigns that resonate with each segment, increasing conversion rates and reducing CAC.

Using Data Analytics for Better Targeting

Leverage data analytics tools to gain insights into customer behavior and preferences. This data can inform your targeting strategies and help you identify new customer segments.

- Behavioral Data: Track how customers interact with your website and app.

- Demographic Data: Gather information about age, gender, and location.

- Psychographic Data: Understand customer values, interests, and lifestyles.

Tailoring your message to your target audience will improve your chances of success.

In conclusion, by refining customer targeting and segmentation, fintech startups can significantly reduce CAC. Understanding your audience better allows you to create more effective marketing campaigns, increase conversion rates, and improve overall ROI.

Enhancing User Experience (UX) and Conversion Rates

Improving user experience (UX) and conversion rates is a critical factor in lowering your Fintech Startup Customer Acquisition Cost: How to Reduce It by 15% in 3 Months. A seamless and intuitive user experience can significantly increase customer satisfaction and conversion rates.

Focus on how to improve UX and conversion rates.

Optimizing Your Website and App Design

Ensure your website and app are user-friendly, visually appealing, and easy to navigate. A clean and intuitive design can reduce friction and encourage users to explore your offerings.

Streamlining the Onboarding Process

Simplify the onboarding process for new users. Reduce the number of steps required to sign up and start using your services. A smooth onboarding experience can increase customer retention and reduce churn.

A/B Testing for Improved Conversions

Conduct A/B tests to identify the most effective elements on your website and app. Test different headlines, images, and calls to action to optimize conversion rates.

- Clear CTAs: Use compelling calls to action that encourage users to take the desired action.

- Mobile Optimization: Ensure your website and app are optimized for mobile devices.

- Fast Loading Times: Optimize your website and app for fast loading times.

A seamless user experience can boost conversions and reduce acquisition costs.

In conclusion, enhancing UX and conversion rates is a vital strategy for reducing CAC. By optimizing website and app design, streamlining the onboarding process, and conducting A/B tests, fintech startups can create a more engaging and satisfying user experience, leading to higher conversion rates and lower acquisition costs.

Implementing Referral Programs and Loyalty Initiatives

Referral programs and loyalty initiatives can be highly effective in reducing your Fintech Startup Customer Acquisition Cost: How to Reduce It by 15% in 3 Months. These programs leverage existing customers to acquire new ones, often at a fraction of the cost of traditional marketing channels.

Let’s explore how to construct these programs.

Creating a Compelling Referral Program

Design a referral program that incentivizes existing customers to refer new users. Offer rewards for both the referrer and the referred party. The rewards should be valuable and relevant to your target audience.

Building Customer Loyalty Through Rewards

Implement a loyalty program that rewards customers for their continued patronage. This can include points, discounts, or exclusive access to new features. Loyal customers are more likely to make repeat purchases and refer new users.

Promoting Your Programs Effectively

Promote your referral and loyalty programs through various channels, including email, social media, and in-app notifications. Make it easy for customers to participate and track their rewards.

- Easy Sharing: Provide tools for customers to easily share referrals with their network.

- Clear Communication: Clearly communicate the benefits of your programs to both existing and potential customers.

- Track Performance: Monitor the performance of your programs and make adjustments as needed.

Referral programs and loyalty initiatives can be a cost-effective way to acquire new customers.

In conclusion, referral programs and loyalty initiatives offer a powerful way to reduce CAC. By incentivizing existing customers to refer new users and rewarding customer loyalty, fintech startups can acquire new customers at a lower cost and foster long-term relationships.

Monitoring and Adjusting Your Strategies

Reducing your Fintech Startup Customer Acquisition Cost: How to Reduce It by 15% in 3 Months is an ongoing process. Continuous monitoring and adjustment of your strategies are essential to ensure you stay on track and achieve your goals.

Here’s how to continue monitoring and adjusting.

Tracking Key Performance Indicators (KPIs)

Regularly track key performance indicators (KPIs) such as CAC, conversion rates, customer lifetime value (CLTV), and marketing ROI. This will provide insights into the effectiveness of your strategies and identify areas for improvement.

Analyzing Data and Identifying Trends

Analyze the data you collect to identify trends and patterns. This can help you understand what’s working and what’s not, allowing you to make informed decisions about your marketing and sales efforts.

Making Data-Driven Adjustments

Based on your analysis, make data-driven adjustments to your strategies. This might involve tweaking your marketing campaigns, refining your customer targeting, or optimizing your website and app design.

- Regular Reviews: Conduct regular reviews of your KPIs and marketing strategies.

- Flexibility: Be prepared to adapt your strategies as needed.

- Continuous Improvement: Focus on continuous improvement and optimization.

You must continue to track and adapt to succeed.

In conclusion, continuous monitoring and adjustment are essential for reducing CAC. By tracking KPIs, analyzing data, and making data-driven adjustments, fintech startups can ensure they stay on track and achieve their goals of reducing CAC and improving profitability.

| Key Point | Brief Description |

|---|---|

| 🎯 Optimize Marketing Spend | Focus on high-ROI channels and refine marketing strategies. |

| 🔍 Refine Customer Targeting | Identify ideal customer profiles and segment customer base for targeted campaigns. |

| 👍 Enhance User Experience | Improve website and app design for better engagement and conversion rates. |

| 🎁 Implement Referral Programs | Leverage existing customers to acquire new ones through incentives. |

FAQ

▼

Customer Acquisition Cost (CAC) is the total cost a business incurs to acquire a new customer. It includes marketing expenses, sales salaries, and advertising costs.

▼

Reducing CAC can lead to increased profit margins and improved cash flow, making a business more sustainable and attractive to investors.

▼

Creating useful content can attract potential customers wanting to learn about your offerings , which establishes your fintech authority in the industry.

▼

A streamlined onboarding process can increase customer retention and reduce churn, which can reduce the need to acquire more customers.

▼

Tracking data will give insights into how you can improve in different areas such as SEO, better refine your strategies, and help tweak customer targets.

Conclusion

Reducing Fintech Startup Customer Acquisition Cost: How to Reduce It by 15% in 3 Months can be done. By understanding CAC, optimizing marketing spend, refining customer targeting, enhancing user experience, and leveraging referral programs, fintech startups can achieve significant reductions in CAC and improve their bottom line.