US Fintechs: Countering Nation-State Cyber Attacks by 2026

US fintechs must implement advanced cybersecurity frameworks, leverage AI-driven threat intelligence, and foster public-private partnerships to effectively counter the escalating threat of nation-state cyber attacks by 2026, ensuring robust financial sector resilience.

The financial technology (fintech) sector in the United States is a beacon of innovation, but its rapid growth and digital nature also make it an attractive target for sophisticated adversaries. As we look towards 2026, the threat of nation-state cyber attacks on US fintechs is not just theoretical; it’s an escalating reality that demands immediate and comprehensive attention. How can these agile financial innovators fortify their defenses against such formidable, state-sponsored threats?

Understanding the Nation-State Threat Landscape by 2026

By 2026, nation-state actors will continue to refine their cyber warfare capabilities, targeting critical financial infrastructure not only for espionage but also for economic disruption and geopolitical leverage. These adversaries possess vast resources, advanced tools, and often operate with a long-term strategic agenda, making them exceptionally challenging to detect and defend against. Their methods are characterized by persistence, stealth, and a willingness to exploit zero-day vulnerabilities.

The motivation behind these attacks varies, from intellectual property theft and data exfiltration to destabilizing financial markets or undermining public trust in financial institutions. Fintechs, with their interconnected systems, vast data repositories, and often less mature security postures compared to traditional banks, present a tempting target for these state-sponsored groups.

Sophisticated Attack Vectors

Nation-state attacks are rarely simple. They involve a complex interplay of techniques designed to bypass conventional defenses. These can range from highly targeted spear-phishing campaigns to supply chain compromises, where legitimate software updates are infected with malware. The goal is often to establish a long-term presence within a network, allowing for sustained data exfiltration or the ability to launch disruptive attacks at a moment’s notice.

- Advanced Persistent Threats (APTs): These are stealthy, continuous computer hacking processes, often orchestrated by nation-states, targeting specific entities.

- Supply Chain Attacks: Compromising a less secure vendor or partner to gain access to a primary target’s network.

- Zero-Day Exploits: Leveraging unknown software vulnerabilities before patches are available, making detection extremely difficult.

- Destructive Malware: Designed to wipe data, disrupt operations, and inflict maximum damage on critical systems.

Understanding these multifaceted threats is the first step in formulating an effective defense. Fintechs must move beyond reactive security measures and embrace a proactive, intelligence-driven approach to anticipate and mitigate these sophisticated attacks.

Strengthening Foundational Cybersecurity for Fintechs

Building a robust defense against nation-state attacks begins with a strong cybersecurity foundation. This involves not just deploying the latest technologies but also cultivating a security-first culture, where every employee understands their role in protecting sensitive data and systems. By 2026, basic cybersecurity hygiene will be non-negotiable, but fintechs must also adopt advanced, adaptive measures.

This includes rigorous access controls, multi-factor authentication (MFA) across all critical systems, and regular security audits and penetration testing. The dynamic nature of fintech operations, with continuous deployment and integration of new services, necessitates an agile security framework that can adapt quickly to new vulnerabilities and threats. It is no longer enough to secure the perimeter; internal networks must also be segmented and monitored with equal vigilance.

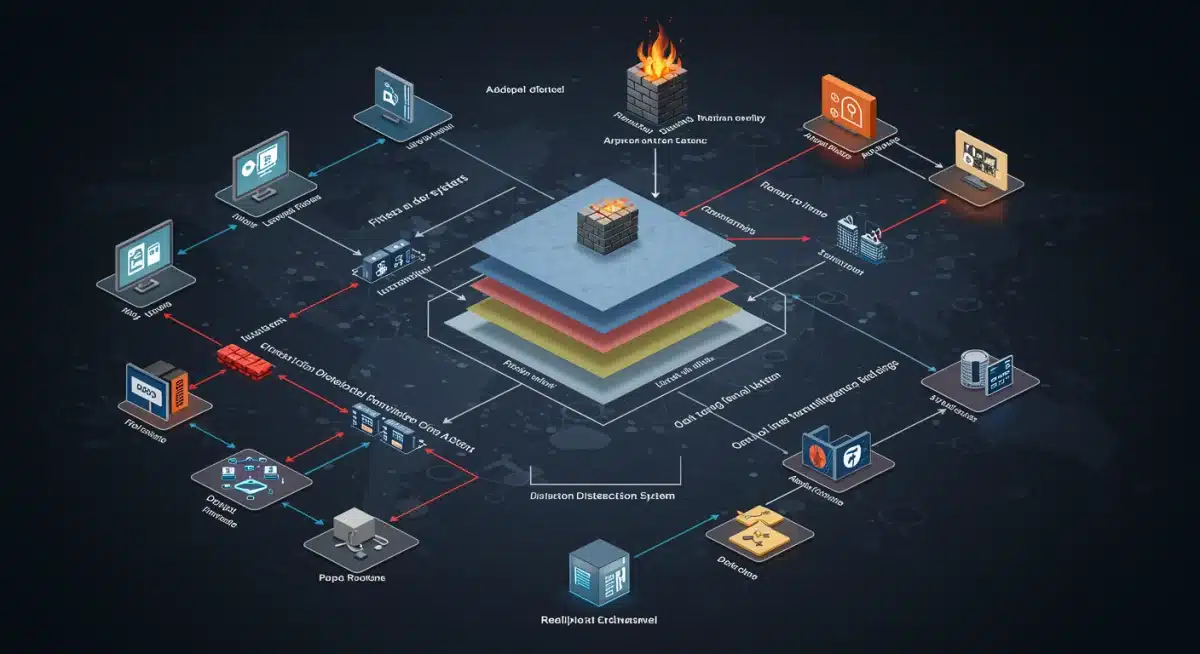

Implementing Zero Trust Architectures

A crucial shift for fintechs is the adoption of a Zero Trust security model. This framework operates on the principle of ‘never trust, always verify,’ meaning no user or device is granted access to resources until their identity and authorization are thoroughly confirmed, regardless of their location (inside or outside the network). This significantly reduces the attack surface and limits the lateral movement of adversaries once they gain initial access.

- Strict Identity Verification: Implement strong authentication for all users and devices accessing critical resources.

- Least Privilege Access: Grant users only the minimum access necessary to perform their job functions.

- Micro-segmentation: Divide networks into smaller, isolated segments to contain potential breaches.

- Continuous Monitoring: Regularly inspect and log all traffic and access attempts for suspicious activity.

Embracing Zero Trust by 2026 will provide fintechs with a more resilient security posture, making it significantly harder for nation-state actors to compromise and exploit their systems.

Leveraging AI and Machine Learning for Threat Intelligence

The sheer volume and complexity of cyber threats demand more than human analysis. Artificial intelligence (AI) and machine learning (ML) are becoming indispensable tools for fintechs in identifying, analyzing, and responding to nation-state cyber attacks. By 2026, these technologies will be central to proactive threat intelligence and automated defense mechanisms.

AI-powered systems can analyze vast datasets of network traffic, user behavior, and threat indicators in real-time, detecting anomalies and patterns that would be missed by traditional security tools. This allows for faster identification of sophisticated attacks, including those employing polymorphic malware or evasive techniques. Predictive analytics, driven by ML, can help anticipate potential attack vectors based on historical data and global threat intelligence feeds.

Automated Incident Response

Beyond detection, AI and ML can significantly enhance incident response capabilities. Automated playbooks can be triggered when a threat is identified, isolating compromised systems, blocking malicious IP addresses, and initiating data recovery processes without human intervention. This speed is critical in mitigating the impact of fast-moving nation-state attacks.

Furthermore, AI can assist in forensic analysis, quickly piecing together the timeline and scope of a breach, enabling fintechs to understand the adversary’s tactics, techniques, and procedures (TTPs) and strengthen future defenses. The integration of these advanced tools will be a differentiator for resilient fintechs in the coming years.

Regulatory Compliance and Collaborative Defense

The regulatory landscape for financial institutions is constantly evolving, and fintechs are increasingly subject to stringent cybersecurity requirements. By 2026, compliance with frameworks like those from the National Institute of Standards and Technology (NIST), the Cybersecurity & Infrastructure Security Agency (CISA), and state-specific regulations will be paramount. However, mere compliance is not enough; fintechs must aim for security excellence beyond the minimum requirements.

Crucially, the fight against nation-state actors cannot be won in isolation. Collaboration between fintechs, traditional financial institutions, government agencies, and cybersecurity firms is essential. Information sharing, joint threat intelligence initiatives, and coordinated defense strategies are vital to create a collective defense posture that can deter and repel sophisticated attacks. Public-private partnerships, such as those facilitated by the Financial Services Information Sharing and Analysis Center (FS-ISAC), will play an increasingly critical role.

Threat Intelligence Sharing Platforms

Participating in threat intelligence sharing platforms allows fintechs to receive real-time alerts about emerging threats, vulnerabilities, and attack campaigns specifically targeting the financial sector. This collective knowledge enables organizations to proactively adjust their defenses and allocate resources more effectively. By sharing anonymized data on attack indicators, fintechs contribute to a larger pool of knowledge, strengthening the entire ecosystem.

- FS-ISAC: A global community for financial sector cyber intelligence sharing.

- Government Initiatives: Programs from CISA and other agencies to disseminate threat information.

- Industry Partnerships: Collaborating with cybersecurity vendors and peers to understand evolving TTPs.

This collaborative approach fosters a stronger, more informed defense strategy, making it harder for nation-state actors to exploit individual vulnerabilities across the sector.

Building Cyber Resilience and Disaster Recovery Plans

Even with the most robust defenses, the possibility of a successful nation-state cyber attack remains. Therefore, by 2026, US fintechs must prioritize cyber resilience and develop comprehensive disaster recovery plans that go beyond simple data backups. Resilience means the ability to withstand an attack, recover quickly, and continue critical operations with minimal disruption.

This involves not only technical solutions but also organizational preparedness. Regular drills and simulations of various attack scenarios, including data breaches, system outages, and destructive malware attacks, are essential. These exercises help identify weaknesses in current plans, train staff, and ensure that recovery procedures are effective and efficient. The goal is to minimize downtime and financial losses, maintaining customer trust even in the face of a significant incident.

Business Continuity Planning (BCP)

A well-defined Business Continuity Plan (BCP) is critical. This plan outlines the procedures and resources required to maintain essential business functions during and after a cyber incident. It should identify critical systems and data, define recovery time objectives (RTOs) and recovery point objectives (RPOs), and establish clear communication protocols for all stakeholders.

- Critical Asset Identification: Understand which systems and data are absolutely essential for operations.

- Redundant Systems: Implement failover systems and geographically dispersed data centers.

- Regular Backups: Ensure secure, immutable backups are regularly performed and tested.

- Communication Strategy: Develop clear internal and external communication plans for crisis management.

Developing and continually refining these plans is paramount for fintechs to navigate the increasingly hostile cyber landscape and maintain operational integrity.

The Human Element: Training and Talent Retention

Technology alone cannot solve the nation-state cyber threat. The human element remains both the strongest defense and the most vulnerable link in any security chain. By 2026, investing in continuous cybersecurity training for all employees, from entry-level staff to executive leadership, will be more critical than ever for US fintechs. This includes regular awareness campaigns on phishing, social engineering, and secure coding practices.

Furthermore, the scarcity of cybersecurity talent is a significant challenge. Fintechs must focus on attracting, developing, and retaining skilled cybersecurity professionals. This involves competitive compensation, opportunities for professional growth, and a culture that values and empowers security teams. A strong security team can interpret threat intelligence, manage complex security systems, and respond effectively to incidents.

Cultivating a Security-First Culture

Security should not be an afterthought but an integral part of every business process and decision. This means embedding security into the software development lifecycle (SDLC), from design to deployment. Developers need to be trained in secure coding practices, and security reviews should be standard at every stage. Leadership must champion this culture, demonstrating its commitment through resource allocation and policy enforcement.

Regular phishing simulations and social engineering tests can help reinforce employee awareness and identify areas for further training. Empowering employees to report suspicious activities without fear of reprisal is also crucial for early threat detection. Ultimately, a well-trained and security-conscious workforce is a formidable barrier against even the most advanced adversaries.

| Key Defense Strategy | Brief Description |

|---|---|

| Zero Trust Architecture | Never trust, always verify all users and devices, minimizing lateral movement. |

| AI/ML Threat Intelligence | Automated detection and analysis of complex threats, enabling faster response. |

| Collaborative Defense | Information sharing and partnerships with government and industry peers. |

| Cyber Resilience Planning | Comprehensive BCP and disaster recovery to minimize disruption and ensure continuity. |

Frequently Asked Questions

Nation-state attacks are characterized by their strategic objectives, vast resources, and advanced techniques, often aiming for geopolitical influence, economic disruption, or intelligence gathering. They typically involve sophisticated APTs and zero-day exploits, making them harder to detect than common cybercrime.

Fintechs are attractive due to their rapid digital transformation, interconnected systems, and often large holdings of sensitive financial data. Their agility can sometimes lead to security being a secondary concern, and their innovative nature makes them a prime target for intellectual property theft by state actors.

AI and ML provide real-time threat detection by analyzing vast amounts of data for anomalies and patterns indicative of sophisticated attacks. They enable predictive analytics and automate incident response, significantly reducing detection and response times, which is crucial against persistent state-sponsored threats.

Regulatory compliance establishes a baseline for cybersecurity standards, forcing fintechs to implement essential controls. While not a complete solution, frameworks like NIST provide guidelines that, when rigorously followed and expanded upon, can significantly bolster defenses against nation-state actors.

Public-private partnerships facilitate crucial threat intelligence sharing, enabling fintechs to stay informed about evolving nation-state tactics. Collaborative efforts, such as those with government agencies and industry groups, create a unified front, enhancing collective defense and resilience across the financial sector.

Conclusion

The evolving threat landscape demands that US fintechs approach cybersecurity with an unprecedented level of vigilance and sophistication. By 2026, successfully countering nation-state cyber attacks will rely on a multi-faceted strategy encompassing robust foundational security, the adoption of Zero Trust architectures, and the strategic leverage of AI and machine learning for proactive threat intelligence and automated response. Furthermore, active participation in collaborative defense initiatives and a deep commitment to cyber resilience through comprehensive business continuity planning are non-negotiable. Ultimately, fostering a security-first culture and investing in skilled human capital will be the bedrock upon which the future security and integrity of the US fintech sector are built, ensuring its continued innovation and stability against the most formidable adversaries.