Fintech Startup Exits 2026: Key Acquisition Factors

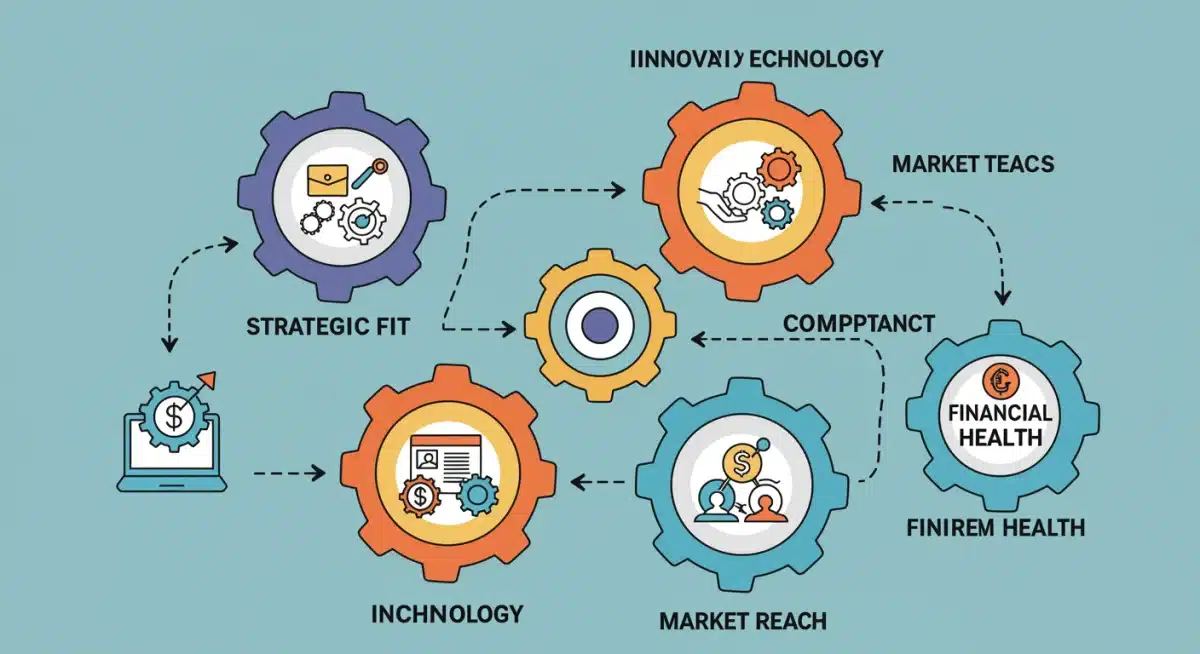

Fintech startup exits in 2026 are primarily driven by strategic alignment, technological innovation, regulatory compliance, market penetration, and strong financial performance, offering a clearer path for successful acquisitions.

The landscape of financial technology is constantly evolving, and understanding the dynamics of Fintech Startup Exits in 2026 is paramount for founders, investors, and potential acquirers. As the industry matures, the pathways to successful acquisitions become more defined, yet no less complex. This article delves into the critical elements that will shape these high-stakes transactions in the coming year.

Strategic Alignment and Synergistic Value

In 2026, the primary driver for any successful fintech acquisition will undoubtedly be strategic alignment. Acquirers are not just buying technology or a customer base; they are investing in a future where the acquired entity seamlessly integrates into their existing ecosystem, amplifying their strategic objectives.

This goes beyond mere operational fit. It encompasses a shared vision for market expansion, product diversification, or even a cultural congruence that ensures a smooth post-acquisition transition. Companies are increasingly looking for targets that fill a specific gap or accelerate their roadmap in critical areas like AI-driven analytics or embedded finance.

Identifying Complementary Business Models

Acquirers are meticulously evaluating how a target company’s business model complements their own. This often involves a deep dive into:

- Market Niche Expansion: Does the startup open doors to new customer segments or geographic markets that were previously inaccessible?

- Product Portfolio Enhancement: Does the acquisition add innovative products or features that enhance the acquirer’s existing offerings, creating a more comprehensive solution for customers?

- Technological Integration Potential: How easily can the startup’s technology be integrated with the acquirer’s existing infrastructure, minimizing disruption and maximizing efficiency?

The emphasis is on creating a sum greater than its parts, where the combined entity can achieve market dominance or significant competitive advantage. A clear, articulated synergy plan from the startup’s side can significantly boost its attractiveness to potential buyers.

Cultural Fit and Team Integration

Beyond the numbers and technology, the human element remains crucial. Cultural alignment between the acquiring and acquired teams can make or break a deal. Acquirers are increasingly scrutinizing the startup’s leadership, team dynamics, and overall company culture during due diligence.

A harmonious integration of teams ensures continuity, retains key talent, and fosters innovation post-acquisition. Startups that demonstrate a strong, adaptable culture and a clear plan for talent retention will be viewed more favorably. Ultimately, strategic alignment forms the bedrock upon which all other acquisition factors are built, dictating the long-term success and value generation of the combined entity.

Pioneering Technological Innovation

The fintech sector thrives on innovation, and in 2026, startups demonstrating truly pioneering technology remain highly sought after. Acquirers are constantly searching for solutions that offer a significant competitive edge, whether through novel algorithms, advanced data processing capabilities, or revolutionary user experiences. This focus on cutting-edge tech is not just about novelty; it’s about solving complex problems with efficiency and scalability.

The ability of a startup to showcase proprietary technology that is difficult to replicate, offers superior performance, or addresses emerging market needs is a powerful magnet for acquisition interest. This often translates into patents, unique data sets, or deeply specialized AI/ML models that can transform financial services. The value of this innovation is intrinsically linked to its potential for future growth and disruption within the broader financial ecosystem.

Disruptive Capabilities and IP Portfolio

Acquirers are particularly interested in fintech startups that possess disruptive capabilities. This includes technology that:

- Redefines user experience: Offering intuitive, seamless, and personalized financial interactions.

- Optimizes operational efficiency: Automating complex processes, reducing costs, and improving speed.

- Generates actionable insights: Leveraging big data and AI for predictive analytics, risk management, and personalized financial advice.

A strong intellectual property (IP) portfolio, including patents, trademarks, and trade secrets, provides a significant advantage. It not only protects the startup’s innovations but also offers a tangible asset that increases its valuation and reduces risks for the acquirer. Demonstrating a clear path to continued innovation and IP development can make a startup exceptionally attractive.

Scalability and Future-Proofing

Technological innovation must also be coupled with scalability. An acquirer needs assurance that the startup’s technology can handle increased transaction volumes, user growth, and evolving market demands without significant overhaul. This involves robust architecture, cloud-native solutions, and a modular design that allows for easy expansion and adaptation.

Furthermore, the technology should be inherently ‘future-proof,’ meaning it’s built on modern, adaptable frameworks that can integrate new functionalities and withstand rapid technological shifts. Startups that have invested in secure, resilient, and scalable platforms are far more likely to capture the attention of major players looking for long-term strategic assets. The depth and breadth of a startup’s technological prowess are critical determinants of its exit potential in 2026.

Robust Regulatory Compliance and Risk Management

In the highly regulated financial sector, regulatory compliance is not merely a checkbox; it’s a fundamental pillar of trust and operational viability. For fintech startups eyeing an exit in 2026, demonstrating robust compliance frameworks and proactive risk management is non-negotiable. Acquirers, particularly established financial institutions, are extremely risk-averse and will scrutinize a target’s adherence to all relevant financial regulations, data privacy laws, and cybersecurity standards.

The complexity of the regulatory landscape, especially in the US, means that startups must have a sophisticated understanding of their obligations, from KYC (Know Your Customer) and AML (Anti-Money Laundering) to consumer protection and data governance. Any perceived weakness in this area can be a significant deal-breaker, regardless of how innovative the technology may be.

Navigating the Evolving Regulatory Landscape

The regulatory environment for fintech is dynamic, with new rules and guidelines emerging constantly, particularly concerning digital assets, open banking, and AI ethics. Startups that have proactively adapted to these changes and built flexible compliance programs are highly valued. This includes:

- Proactive compliance strategy: Not just reactive, but anticipating future regulatory shifts.

- Clear audit trails: Documenting all compliance efforts and maintaining transparent records.

- Dedicated compliance teams: Investing in expertise to manage regulatory complexities.

Demonstrating a clear understanding of federal and state-specific regulations, such as those from the CFPB, FinCEN, and various state banking departments, is crucial for US-based fintechs. Acquirers need confidence that they won’t inherit significant regulatory liabilities or face costly enforcement actions post-acquisition.

Data Security and Privacy Standards

With data breaches becoming increasingly common and costly, a startup’s data security and privacy protocols are under intense scrutiny. Compliance with frameworks like GDPR (even for US companies dealing with global data), CCPA, and upcoming federal privacy legislation is paramount. Acquirers will conduct thorough cybersecurity audits to assess the robustness of a target’s systems.

This involves not only technical safeguards but also strong internal policies, employee training, and incident response plans. Startups that can prove an impeccable track record in protecting customer data and maintaining privacy will significantly de-risk the acquisition for potential buyers, making them far more appealing in a competitive market where trust is currency. Effective risk management, therefore, is not just about avoiding penalties but about building a reputation for reliability.

Market Penetration and Customer Acquisition

A fintech startup’s market penetration and its proven ability to acquire and retain customers are critical indicators of its value and future growth potential. In 2026, acquirers are looking for more than just a good idea; they demand evidence of traction, a scalable customer base, and a clear path to expanding market share. This factor speaks directly to the revenue-generating capabilities and the perceived long-term viability of the startup.

Successful market penetration demonstrates that the startup has validated its product-market fit, effectively navigated competitive landscapes, and built a loyal user base. This significantly de-risks the acquisition for buyers, as it means they are inheriting an established presence and a proven customer acquisition engine rather than having to build one from scratch. Metrics such as customer lifetime value (CLTV), customer acquisition cost (CAC), and churn rates become central to this evaluation.

Scalable Customer Acquisition Channels

Acquirers are keenly interested in understanding a startup’s customer acquisition strategy and its scalability. This includes evaluating:

- Diverse acquisition channels: Are customers coming from a variety of sustainable sources, or is reliance placed on a single, potentially fragile channel?

- Cost-effectiveness: Is the cost of acquiring new customers sustainable and indicative of future profitability?

- Retention strategies: What mechanisms are in place to ensure ongoing customer engagement and loyalty, minimizing churn?

Startups that have developed efficient, repeatable, and scalable customer acquisition models, whether through organic growth, strategic partnerships, or effective digital marketing, will stand out. Evidence of strong network effects or viral growth can further enhance attractiveness, indicating a robust and self-sustaining growth trajectory.

Brand Recognition and User Engagement

Beyond raw numbers, the strength of a startup’s brand and the level of user engagement are powerful assets. A well-recognized brand with a positive reputation in its niche can significantly accelerate an acquirer’s market entry or expansion efforts. High user engagement, demonstrated through active usage, positive reviews, and community participation, signifies a sticky product and a loyal customer base.

This qualitative aspect of market penetration is often as important as quantitative metrics. Acquirers understand that a strong brand and engaged users reduce future marketing costs and foster a competitive moat. Therefore, startups that have successfully cultivated a distinctive brand identity and fostered a highly engaged user community will be positioned for more favorable exit outcomes in 2026, showcasing their ability to not just attract but also retain valuable customers.

Financial Performance and Growth Trajectory

Ultimately, a successful acquisition hinges on strong financial performance and a compelling growth trajectory. In 2026, while innovation and market presence are vital, acquirers will apply rigorous financial scrutiny to ensure the investment yields a significant return. This involves a deep dive into revenue streams, profitability, burn rate, and projected financial models. Startups must demonstrate not only current financial health but also a clear, sustainable path to future growth and profitability.

Investors and corporate buyers seek evidence that the startup is not just surviving but thriving, with robust unit economics and a business model capable of scaling profitably. This often means showcasing consistent revenue growth, manageable operating expenses, and a clear understanding of the levers that drive financial success. Any ambiguities or inconsistencies in financial reporting can raise red flags and deter potential acquirers, emphasizing the need for transparency and meticulous record-keeping.

Revenue Models and Profitability

A startup’s revenue model is a key point of interest. Acquirers evaluate:

- Diversity of revenue streams: Dependence on a single revenue source can be risky; diversified streams indicate resilience.

- Recurring revenue: Subscription-based models or long-term contracts are highly valued for their predictability.

- Path to profitability: Even if not currently profitable, a clear, credible roadmap to achieving profitability is essential.

Detailed financial projections, backed by realistic assumptions and historical data, are crucial. Startups need to articulate how they plan to grow their top line while managing their bottom line, demonstrating an understanding of their cost structure and margin potential. The ability to show strong gross margins and efficient capital utilization significantly enhances a startup’s financial appeal.

Valuation Metrics and Investor Confidence

The valuation of a fintech startup is a complex interplay of current financial performance, future growth potential, and market comparables. Acquirers will assess various metrics, including:

- Revenue multiples: Comparing the startup’s valuation against industry benchmarks.

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): If applicable, indicating operational profitability.

- Customer acquisition metrics: The efficiency and cost of gaining new users.

Furthermore, strong investor confidence, evidenced by successful previous funding rounds from reputable venture capitalists, can signal a startup’s perceived value and potential. This external validation provides a level of assurance to potential acquirers. A well-managed balance sheet, transparent financial statements, and a compelling narrative around financial health and future growth are indispensable for securing a favorable exit in the competitive fintech M&A landscape of 2026. The financial story a startup tells must be compelling, credible, and sustainable.

| Key Factor | Brief Description |

|---|---|

| Strategic Alignment | Seamless integration potential and shared vision with acquirer. |

| Technological Innovation | Proprietary, scalable, and disruptive technology with strong IP. |

| Regulatory Compliance | Robust frameworks, proactive risk management, and data security. |

| Market Penetration | Proven customer acquisition, retention, and brand recognition. |

Frequently Asked Questions About Fintech Exits in 2026

Strategic alignment is often the most crucial factor. Acquirers seek startups that not only offer innovative solutions but also seamlessly fit into their long-term vision, enhancing existing offerings or opening new market segments. Without a clear strategic fit, even highly innovative startups may struggle to find suitable acquirers.

Regulatory compliance is critically important. Acquirers, especially established financial institutions, prioritize targets with robust compliance frameworks, strong data security, and clear risk management. Non-compliance can lead to significant liabilities and reputational damage, making it a major deterrent for potential buyers in 2026.

Technological innovation is a powerful magnet. Acquirers are constantly seeking proprietary, scalable, and disruptive technologies that offer a competitive edge. This includes advanced AI, unique data processing, or revolutionary user experiences, all backed by a strong intellectual property portfolio that ensures long-term value and differentiation.

Market penetration demonstrates proven traction and customer validation. Acquirers look for startups with a scalable customer base, efficient acquisition channels, and high retention rates. A strong brand and engaged users reduce future marketing costs and signify a viable, growing business with established revenue streams.

Financial metrics are fundamental. Acquirers scrutinize revenue streams, profitability, burn rate, and growth projections. Startups must show a clear path to sustainable growth and profitability, supported by robust unit economics and transparent financial reporting. Strong financial performance de-risks the investment and justifies valuation.

Conclusion

The landscape for Fintech Startup Exits in 2026 is characterized by a sophisticated interplay of strategic positioning, technological superiority, unwavering regulatory adherence, demonstrable market traction, and sound financial health. For founders aiming for a successful acquisition, focusing on these five key factors will be paramount. It’s no longer enough to simply innovate; startups must build comprehensive, resilient businesses that offer clear strategic value to potential acquirers. As the fintech industry continues its rapid evolution, those that meticulously prepare across these dimensions will be best positioned to capitalize on the robust M&A opportunities that 2026 promises.